Update: Bonus is back to 40,000/60,000.

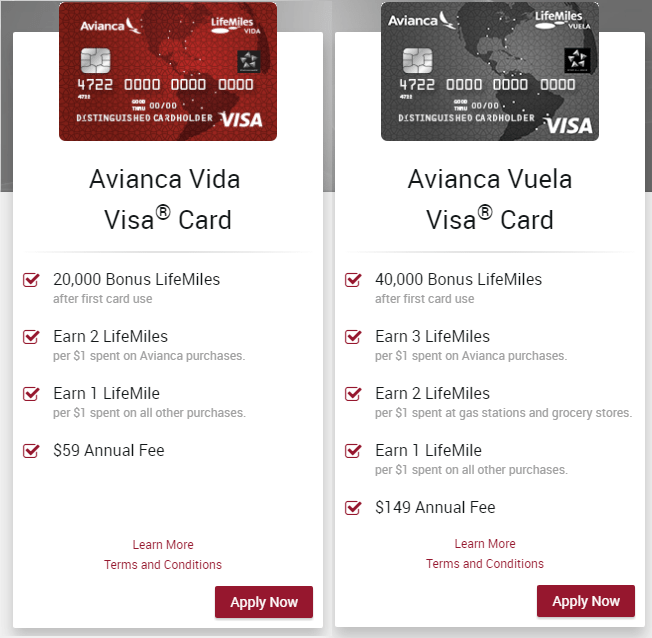

There looks to be two new Avianca credit cards available, big thanks to Amol at Travel Codex for providing me with the application link:

Both of these cards are issued by Banco Popular de Puerto Rico, they normally trade under the name Popular Community Bank in the United States. I’m not exactly sure if you can sign up for these new cards yet or not, as there was supposed to be a 60,000 mile offer initially (although maybe they meant you could get 60,000 miles by applying for both cards?) and the e-mail that contained the link to these cards still said coming soon. There was also a generic promotional code of AVSPWE given in the e-mail and an area for that promo code to be added in (under financial information) – that e-mail also specifically references the Vuela card so I imagine that bonus is only available on that card. Reader @TProphet applied and was approved, so I imagine the links are live now. But who knows if the 60,000 bonus with the promo code will work or not.

Let’s take a look at both card’s in a bit more detail.

Contents

Avianca Vida Visa Card Review

- Sign up bonus of 20,000 Avianca LifeMiles after first purchase within 90 days of account opening

- Annual fee of $59 is not waived first year

- Card earns at the following rates:

- 2x LifeMiles per $1 spent on Avianca purchases

- 1x LifeMiles per $1 spent on all other purchases

- 15% discount on purchases of miles with Multiply Your Miles

Fine print for Multiply Your Miles can be found here.

Avianca Vuela Visa Card Review

- Sign up bonus of 40,000 Avianca LifeMiles after first purchase within 90 days of account opening (possibly 60,000 miles by using promo code AVSPWE. Enter this under financial information on the application form)

- Annual fee of $149 is not waived first year

- Card earns at the following rates:

- 3x LifeMiles per $1 spent on Avianca purchases

- 2x LifeMiles per $1 spent on gas stations and grocery stores

- 1x LifeMiles per $1 spent on all other purchases

- Free additional piece of baggage for travel between the United States & Central America

- A 50% discount on an award ticket redeemed for travel to Central America or Colombia from the United States after $12,000 spent each year

- An additional 50% discount on an award ticket redeemed for travel to Central America or Colombia from the United States after $12,000 spent each year

- 15% discount on purchases of miles with Multiply Your Miles

- 0% Introductory APR on balance transfers from the date you transfer (2% fee with a maximum of $10 being applied)

The fine print of the award ticket states that travel must be booked in X class (economy). Award flights from North America to Central America (Costa Rica, Panama, Nicaragua, Honduras, Guatemala, El Salvador) cost as follows (one way, so double for return):

- Economy: 18,000 miles

- Business: 36,000 miles

- First: 46,000 miles

Flights from North America to Colombia cost:

- Economy: 20,000 miles

- Business: 40,000 miles

- First: 50,000 miles

When I read the fine print, it looks like multiple tickets can be booked at once to receive this discount. Depending on how all of this works at practice, spending $12,000/$24,000 on this card might make sense for some people. If it’s only for a single ticket then you’ll be saving 20,000 miles, that’s basically an extra 1.67x miles per one dollar spent. If it’s for multiple tickets then it would be an extra 1.67x per dollar spent multiplied by how many tickets you’re redeeming for.

Retention Offer

After the first year, reader Joshua was able to call in and get the annual fee waived as part of a retention offer.

Redeeming Miles

Full award chart can be found here. Keep in mind they do not charge fuel surcharges.

Our Verdict

Personally I see people getting these cards for the sign up bonus and not much more, but that’s also the case with the majority of airline cards I find. There could be some good value here depending on how the 50% discount exactly works. The fact that these bonuses only require a single purchase is also great for people that struggle to meet minimum spend requirements.

If anybody applies for both cards, let us know if combine inquiries or not. As I said previously, thanks to Amol at Travel Codex, you can read his view on these cards here.

Update: Reconsideration number is (844-343-1010). Tips for reconsideration calls can be found here.

.

Honestly, this card is NOT worth it for more than the miles bonus. I had it for 3 years and they never came through on the half off tickets, the Lifemiles site continues to be really clunky to use, they have archaic methods of getting into your account if you’re ever locked out and gawd forbid you ever have to call customer service.

I finally closed the account today after a month of difficulty getting into my account so I could pay the final payment, they’d charged me $27 for being a few hours late on a $4 balance, it took forever to get that waived and I shut down the account.

Honestly, Delta flies to Bogotá if you’re looking for a good card to get you back and forth from the US to Colombia–and their AmEx is the best rewards card I could have ever wished for.

Stay away from the Lifemiles card unless you have the patience of a saint to deal with their terrible service and inaccessible rewards.

Is there any way to convert these promotion miles to cash back?

AF posted earlier this month. Called in to cancel then CSR offered me a waiver!

Can you apply for and receive the bonus for both of the cards? Do you need to wait a little bit or can do you do it simultaneously?

Not 100% sure, people are saying if they have held either card before they can’t apply for either again. Not sure if you try to apply for both at the same time, but I imagine one won’t be approved. Be the DP you want to see.

I just closed this card yesterday. Any DPs for churning this card? How long to wait before applying for a 2nd card?

Saw that my $149 annual fee just posted. I imagine there are a good number of folks in the same boat? Is there a $0 fee version of the card? Is BP any good at waiving the fee?

I’m out of the country now – otherwise, I’d call them and try to get datapoints myself. Thanks 🙂

Andrew

No idea sorry

where does it say 0 apr offer

AVSPWE is still working, awarded 60,000 today after making payment on first charge. First statement arrived after the due date because of the hurricane, so make sure you get online access ASAP. Mail comes from Puerto Rico. Was able to make one redemption of Lifemiles, but website is temperamental, showing availability one day, then no availability for three days, then back to normal. My advice, if you see something you want, book it, right then. If the website worked well every day, I think this is the best thing going for booking award tickets off of cheap points purchases.

Drew – when did you apply for the card? I haven’t been able to load an application that allows me to enter the AVSPWE code since I first tried to on 9/29 (I’ve tried a few times periodically since then)

Where did you enter the code?

Based on date of post, the code was entered earlier. He was just posting that the code worked to get the extra bonus….that’s how I read it. Approaching my 1 year date…..

the promo code field appears to be back on the app

Yup, the old promo code doesn’t work though. If you find a working one let us know.

Is anyone using Mint.com here? If so can you send in a request to add the https://www.myonlinecreditcard.com which is used by Popular Credit Service for this card?

If Mint gets enough requests, they will add it and we can see activity with mint on our Avianca card.

Thanks. Thanks also for publishing this offer and code.

I had no issues. Reside in California. Applied beginning Sept with the code. Got 60k miles after 2nd billing cycle. The first billing cycle is only a few days but already has the Annual fee.