Offer at a glance

- Interest Rate: 3% APY

- Minimum Balance: None

- Maximum Balance: $15,000

- Availability: All branches are in VA, but looks like you can open nationwide?

- Direct deposit required: No

- Additional requirements: 10 debit card transactions, eStatements and log into online banking

- Hard/soft pull: Soft

- ChexSystems: Unknown

- Credit card funding: At least $500

- Monthly fees: None

- Insured: FDIC

The Offer

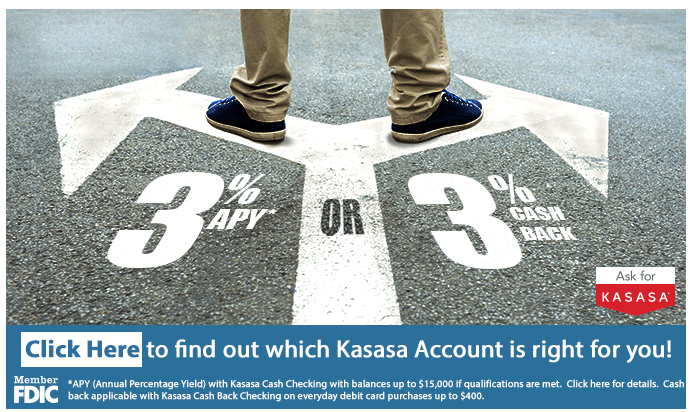

- MainStreetBank is offering 3% APY on balances up to $15,000 on the Kasasa Cash checking account when you complete the following requirements:

- Have at least 12 debit card purchases post and settle

- Be enrolled in and agree to receive e-statements

- Be enrolled in and log into online banking

The Fine Print

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

This account doesn’t have any monthly fees, unsure if there is any early account termination fee or not but shouldn’t matter as if you’re opening it you’ll likely want to keep it long term.

Our Verdict

There are accounts that offer higher APYs than this, but 3% with no direct deposit is competitive and tempting. We need to know more about this bank including if it’s a soft or hard pull to open, if it’s actually available nation wide and if you can initially fund it with a credit card or not. If anybody signs up then please share your experiences in the comments below.

This offer is super old and no longer exists. The checking account now only pays 0.75% APY on balances up to $15k and 0.25% APY on anything more.

+1 on SB’s comment. This account has been gutted and should be removed from the list.

Based on comments from 2016 regarding Mainstreet, it appeared the bank was very strict and desired ordinary spending patterns to qualify for the 3% interest. Is the bank now allowing Amazon 0.50 reloads or small utility payments to meet the debit purchase requirement? Thank you in advance.

I applied when I saw this posted. Chase CC funding seems to have shown up as a purchase so far, and no evidence of a hard credit pull.

Thanks, Andy!

Should have pointed out that I do live in VA, and a few pieces of address verification were requested.

Also, checked free annual Experian report today, and see only soft inquiries on the application date.

hi Andy, did you fund $500 with your CC? I saw on the top of this page it says “at least $500”, but no other data points can be found. Thanks!

I opened an account – CC as limited to $250 – posted to Chase Freedom as a purchase

Are you also located in VA? Thanks!

I’m in Georgia. I applied online. The next day I received an email through the bank’s secure messaging portal requesting a copy of my driver’s license. Account is open and funded. Received my debit card yesterday.

interest rate as of March 2020 is 0.75%

What do you think about their Kasasa Cash Back checking account? The details are on the same page that you linked for the offer.

It provides 3% cash back on purchases made with a debit card on up to $400 worth of spend per month.

To me, that’s more interesting than a 3% checking account with transaction requirements. Higher cash back than most credit cards, and it’s debit.

Because of the small cap of 400… not interesting to most. You would be better off with a 2% CC, unless you never spend more than 400/mo. Also, debit cards have less consumer protections. Try to dispute a charge on your debit card and you find out all about it.

Load this $400 to BB/Serve

Go for it. Be the DP on $12 bucks a month in rewards. But, how long before that gets shutdown? I don’t play the MS game, other than account funding… so, that didn’t occur to me.

It will last till they read this blog

Maybe DoC should delete every article after the first week… And we revisit the subject in a year. Then the patrons get the ability to learn for a week and decide if they want to go for it. See how that works out.

Highly doubt 12 debit loads every month of around $33.34 each to Serve would work for very long, but whatever. MS is not my thing. But there is a reason why they cap it… Some would find a way to milk it to death.

It’s $12 a month, not bad but not great either.

Says “at least 12 debits” per month, on their website. Seems like a bit of a hassle, tbh. If it was Bill Pays that would be one thing, for debits do people go and buy a pack of gum 12 times per month? Or maybe use it for your morning coffee?

Amazon Gift Card reloads for $0.50

I pay my ISP bill online. I make 12 transactions for $.01 each on my debit card (local bank, Kasasa account), then I pay the remaining balance with my preferred credit card.