Update 4/4/20: Max rate is now 2%

Offer at a glance

- Interest Rate: Max of 3% APY

- Minimum Balance: None

- Maximum Balance: $2,000 for 3% APY

- Availability: CA only

- Direct deposit required: None

- Additional requirements: None

- Hard/soft pull: Soft without overdraft protection

- ChexSystems: Unknown, sensitive

- Credit card funding: None

- Monthly fees: None

- Insured: NCUA

The Offer

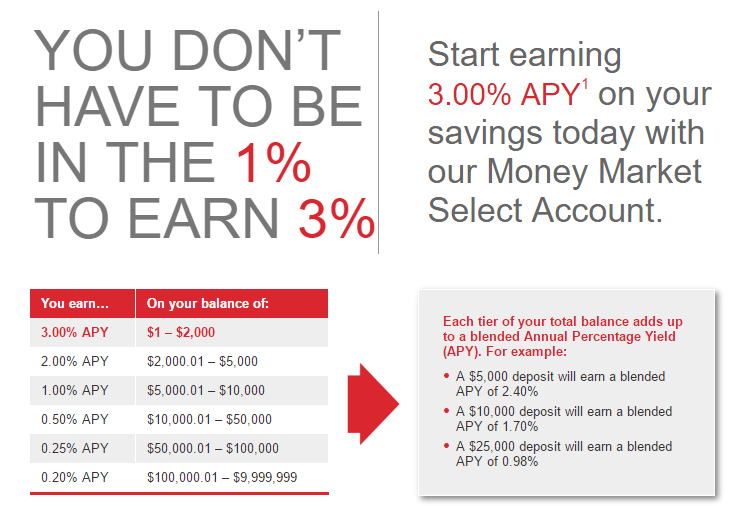

- Patelco offers a money market account with a reverse tiered interest rate (the more you have in the account, the lower APY you receive). The tiers are as follows:

- $0-$2,000: 3% APY

- $2,000-$5,000: 2% APY

- $5,000-$10,000: 1% APY

- Rates continue to decline

The Fine Print

- Limit one Money Market Select Account and Money Market Select IRA Account per account number.

- The maximum number of checks that may clear is three (3) in any calendar month period

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

This account has no monthly fees to worry about.

Eligibility

You need to be a member of this credit union to apply for this account, you can view the full requirements here. The most common ways to be eligible are:

- You live or regularly work, worship or attend school in Alameda, Contra Costa, Marin, Napa, Sacramento, San Francisco, San Mateo, Santa Clara, Solano, or Sonoma counties

- You live or regularly work, worship or attend school in the California cities of Atwater, Auburn, Bakersfield, Eureka, Laguna, Los Banos, McKinleyville, Merced, Rocklin, Roseville, Santa Cruz, or Tracy

Our Verdict

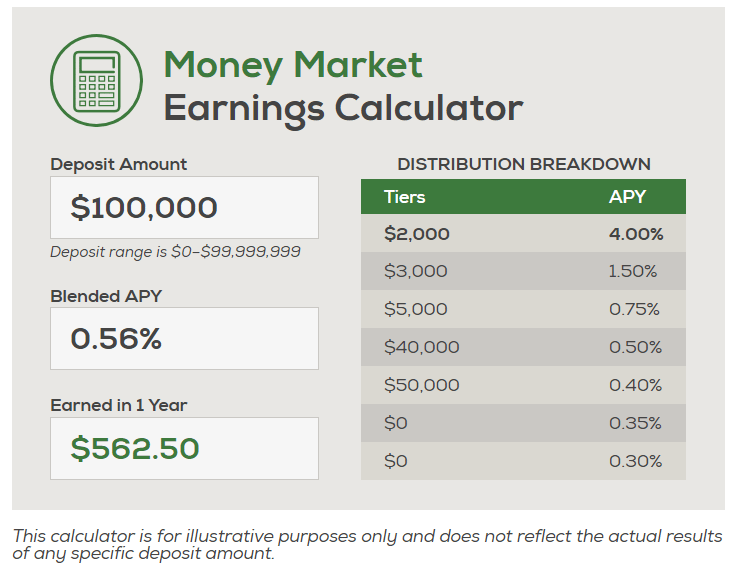

The nice thing about these reverse tiered accounts is that there is no requirements for the higher APY and no minimum deposit required either. The downside is the APY quickly drops as well. If you had $5,000 in the account you’d earn $120 in the first year (or $60 with just $2,000), people would be better off signing up for a checking or savings bonus instead. You can get better than 1% APY on other accounts with no requirements, so no point putting more than $5,000 into this account. They also offer a credit card that is 2% everywhere and 3% on travel/restaurants.

This is no longer a good deal, I wonder if Patelco will increase rates any time soon?

Patelco not willing to waive in-branch sign up requirement during global pandemic. Not going to give them my money.

$50 referral bonus to new customers:

Referral code is: R4MQWPVP

When new customers use the referral code R4MQWPVP to open their new checking account with a $100 minimum deposit and become a new member, they will receive $50

This limited-time offer ends November 20, 2020.

Rate dropped to 2%

Chex sensitive. Denied due to Chex.

You also need to visit a branch to provide a driver’s license or state ID. No faxes or emails accepted. So, you may want to make sure you live near a branch.

They accept emails now. I just called them, they said email is acceptable, and they set up my account shortly after I emailed my photo ID.

Not for my account. only physically going in-branch during global pandemic is accepted.

Weird, especially since they are only asking for copies, not original documents. Phone support even said there is no clear reason why they are asking for an in-person visit. Boo, Patelco!

I’d much rather open a “set it and forget it” account such as this than play the YMMV dance with savings bonuses such as the Capital 1 $200 offer that’s still murky with targeting feedback from Cap1. I have a very limited amount of time I can dedicate towards bonus hunting and prefer SIFI (my acronym) even if it’s a smaller return.

Does anyone know if you can have multiple of these accounts? I assume the answer is no, but the terms only indicate that it’s one per account number and not member/person. This isn’t something I’d directly ask them so any data points would be greatly appreciated.

This wouldn’t be a bad place to park $5k, earn 2.4% APY, and have free checks on standby in the event you need to make a payment towards that water heater or emergency room visit.

Single account per member. That’s why I signed up my wife 🙂

Thanks for the reply. Are you 100% sure that you can’t have 2+ accounts per member though? The language in the terms is a bit odd. Maybe I’m reading too much into this.

https://www.patelco.org/assets/files/membership/Member_Handbook_Addendum.pdf

You can have one MMA and one MMA IRA per “account number”, that is per member.

Patelco is a good CU – take MOs without too many issues – and why I already had an account. Got this tiered-rate account last month – only took about 5 mins to set up in-branch. No hard pull

FWIW, their 2% cb credit card seems fairly decent except for the $85AF (first year waived).

This tiered accont has to be the easiest high interest rate account around – no monthly debit card or ACH nonsense required. Am setting up another account for my SO and will put $10K in each to get blended rate of 1.7% for $20K.

Also have several Super Reward Checking accounts with Provident CU that earn 2% up to $25K. Good places to stash some liquid savings for those in the Bay Area.

um this account that earns 2% from patelco requires monthly spend of $500. at least when i went to the site today….

I meant from provident CU

? For Provident, it’s $300 a month purchase.with a debit card to get the 2% rate (I buy a $300 MO once a month – costs all of 70c). To get the $150 signup bonus you need two consecutive monthly $500 DD (ACH works). After you get the bonus, any ACH amount works (so I send an automatic $10 ACH every month – min my bank allows). 2% for $25K with minimal effort.

I have dual accounts at Provident and Patelco and get $70K earning just under 2%

I also have 2 Lake Michigan 3% accounts with $15K each. So able to get over 2% on $100K for liquid deposits. Decent return for minimal effort.

Couple of questions for you if you don’t mind regarding Provident CU.

Were you able to get two bonuses? DoC post from last year started one bonus per household but in your case you have two accounts.

Approximately how many chexsystem inquiries did you have in the previous 2 years when applying?

I assume you don’t have their CC? Curious if you can combine HP with account opening + CC application.

TIA.

I opened up one of these last month in-person. It is soft pull according to rep & I have not seen any hard pulls showup.

The rep & staff were friendly enough, but I found that the rep who opened the account was very nosy about my financial situation, more so than Chase (when opening savings only in person) who also was nosy, and something I have not experienced with several other credit unions. Also she did a hard sell on their products, especially pushing the credit cards hard, which Chase didn’t do. I don’t know if this is typical or more so because I was only opening basic share savings and the 3% Money Market.

She did at least make it clear that you need to make one transaction every 6 mo to keep it active and prevent an inactivity fee.

First statement shows I am receiving 2.98%.

I think I will keep it one year and then determine if it is worth keeping.

Been 2 years. Still worth keeping?

I’ve had this account for the past 2+ years. 1) Even though they say on their website that this is an account that gives checks, every person I’ve ever asked said that you can’t get checks with this account. 2) up to 6 transfers like a savings account. 3) no hard pull, and it’s pretty much an instant acceptance. You’ll need to use an ACH or check if you don’t already have a primary account with them. I also don’t think Patelco will let you have a money market only; you’ll also need to have the basic savings.

I opened this 3% MM and they opened a savings account themselves and put a dollar in it. Isn’t that neat!