Bonus is currently 50,000 points.

Introduction

Synchrony has announced a new co-branded credit card partner, this time they are getting into the hotel game with Stash Hotel Rewards. If you haven’t heard of Stash Rewards before, they are basically a rewards program for independent hotels. The vast majority of their hotels are in mainland United States, although there are a few properties in the Carribean, Hawaii & Panama as well (a full list of their properties can be found here).

The Credit Card

As mentioned Stash have just released their credit card. It’s a pretty basic offering, so let’s take a quick overlook at it:

- Earns at the following rates:

- 3x points at Stash hotels

- 2x points at all other hotels, dining & gas purchases

- 1x points on all other purchases

- Sign up bonus of 10,000 Stash points after $1,500 in purchases within three months of signing up

- Annual fee of $85 is waived the first year

- 10% rebate of your points when you redeem them for a participating stay

It’s always impossible to value a product offering like this without having a look at how useful the loyalty points actually are, so let’s do just that.

How Much Are Stash Rewards Points Worth?

There are a few key things you should know about Stash Rewards Points:

- They can only be redeemed for free hotel nights

- There are no black out dates

- Your points never expire (although your account can be cancelled if it’s been inactive for 18+ months which is basically the same thing)

- You don’t earn Stash points for bookings made on third party sites

- There are no membership tiers, everybody earns at the same rate

If you go to the redeem section of the Stash Rewards website, you’ll see they give a few sample redemption options all with a big * next to them. This leads you to the following fine print:

Examples for illustration purposes only based on estimated number of Stash points needed to earn a free night at identified hotels within the next 14 days. Actual number of points needed is subject to change based on a number of factors, including seasonality & occupancy rate.

Ok that’s understandable, they don’t want fixed awards because they people could get supersized value during busy periods. Although you think they would just tie the redemption rate to the price of a hotel, because that would already take those factors into account. Let’s try to see if that’s what they do, here are some examples:

- Elan Hotel Los Angeles 24th to 25th of October: 16,262 points or $189 (1.16¢ per point)

- Cranwell Resort, Spa, and Golf Clu (7th to 8th of November): 29,749 points or $315 (1.06¢ per point)

- Princess Anne Hotel 4th to 5th of December: 13,142 points or $247 (1.88¢ per point)

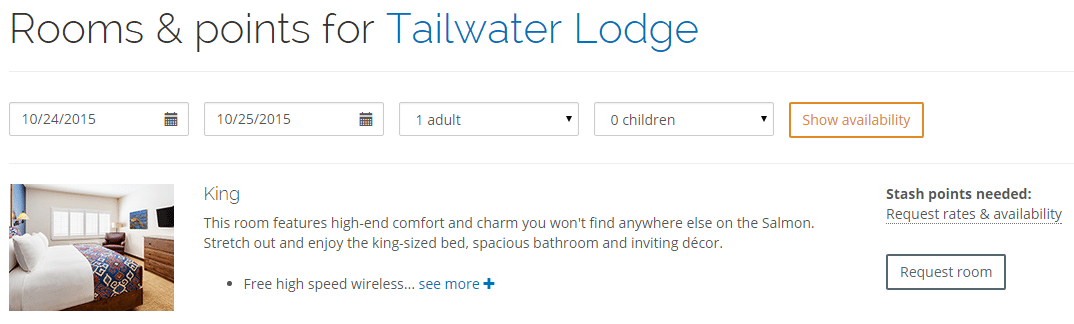

As you can see it doesn’t seem to be tied to the value of a paid stay, but I suspect you’ll get value anywhere in the 1-2¢ per point range. To make matters worse, some hotels require to request availability and won’t show you a points value directly. For example the Tailwater Lodge in NYC.

Our Verdict

If you’re truly a fan of independent and boutique hotels, I really don’t see why you’d limit yourself to a loyalty program like Stash that only has a foot print of 200 or so hotels worldwide (and don’t expect this to climb rapidly, the credit card is new but Stash has been around since at least late 2010). You don’t earn any Stash points unless you book direct, which means you’d be missing out on a 18% discount by not going through Hotels.com.

The credit card itself is lackluster, at best you’re going to be able to get one night stay at a budget property for free. Most other hotel credit cards offer two nights at their best properties and even more at their cheaper properties. The earning rates are also lackluster, even 3x points on Stash hotels isn’t particularly fantastic. The only reason I can see for getting this card is if you had a lot of paid stays at Stash and wanted to take advantage of the 3x earning rate and also the 10% redemption bonus and even then it’d be almost impossible to justify the annual fee of $85.

This card is a strong pass for me, maybe if it had a 40,000+ point sign up bonus I’d feel differently but at only 10,000 there is really no point in wasting a hard pull on this card.

Where did you get this DP/info, “Your points never expire (although your account can be cancelled if it’s been inactive for 18+ months which is basically the same thing)”?

Their site is pretty clear that points never expire. One page even says, “use them in 5 months or 50 years!”

Agree with your “verdict”. Imho, I do not like that word, it’s not like this is a court of law or something. Consider saying our “opinion” or something similar. Cheers!

I agree with this sentiment, but think you should use the term “diagnosis”. You are a fake doctor, not a fake judge.