[Update 9/18/17: According to DansDeals this offer will end tomorrow 9/19/17. PLEASE KEEP IN MIND THAT IT LOOKS LIKE BARCLAYCARD HAS A NEW 6/24 RULE FOR THIS CARD. PLEASE KEEP THIS IN MIND. ALTHOUGH IT DOESN’T LOOK TO BE A TRUE HARD RULE IT’S WORTH READING UP ON]

[Update 9/12/17: According to OMAAT, this signup bonus offer will end within the next few days. Offer began on 9/16/16, almost a year ago.]

The Offer

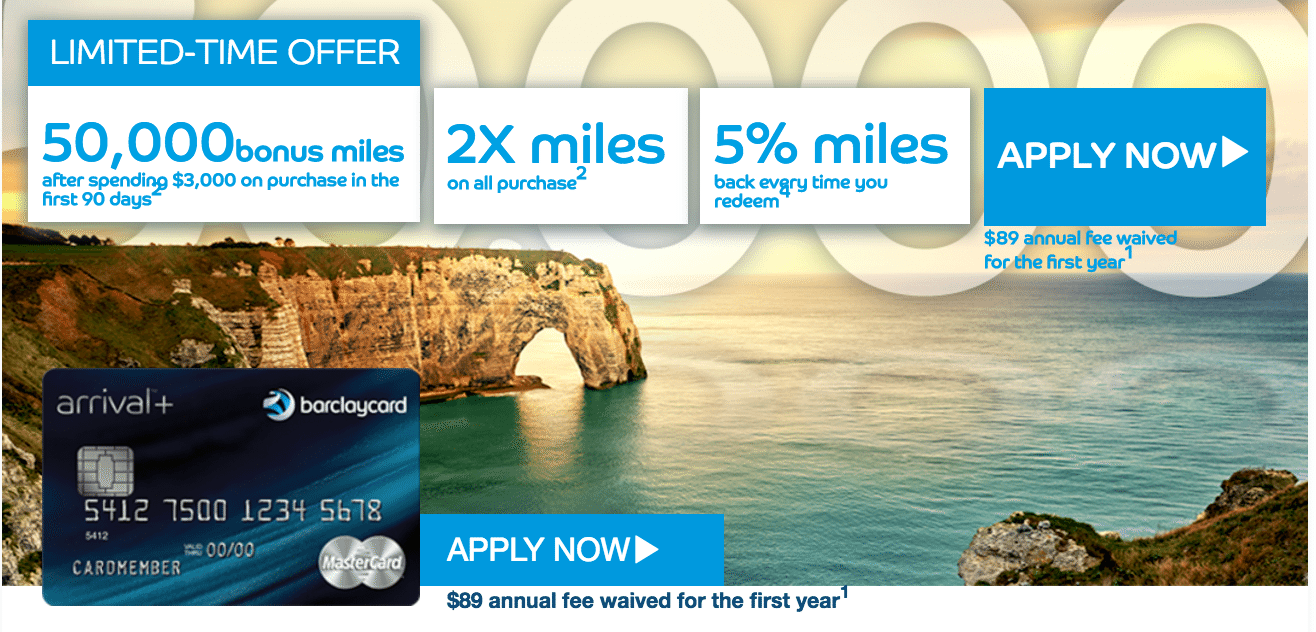

- Signup for the Barclay Arrival Plus World Elite Mastercard and get 50,000 bonus points after spending $3,000 within 90 days

Card Details

Card Details

- $89 annual fee, waived the first year

- No foreign transaction fee

- Points are worth $.01 per point when redeemed for travel (which makes the signup bonus worth $500)

- Double points on all purchases (effective earning rate of 2.1% back on all purchases)

- There’s also a 5% bonus after redeeming points (redeem 50,000 points and get 2500 points bonus, for example)

Our Verdict

The card wasn’t available for signup at all via ordinary channels until a couple weeks ago. Good to see them increase the bonus. I don’t think they’ve ever had anything more than the 40k offer as a public offer so this is a unique opportunity to get an extra $105 value out of the card.

If you just applied recently, try escalating to a supervisor and you might have success getting the new bonus matched.

Remember that Barclay doesn’t limit us to once bonus per life, and so long as you don’t currently have the card you can signup again. And Barclay typically pulls Transunion which is a lesser used bureau. Arrival+ wasn’t on my plate, but maybe I’m considering going for it with the 50k bonus.

It’s worth reading 26 Things You Should Know About Barclaycard Credit Cards before applying.

Hat tip to welltraveledmile

Follow-up Posts:

- How To Get Matched To The 50,000 Barclaycard Arrival Plus Offer

- Can I Get the Barclay Arrival Plus if I have the No-Fee Arrival?

I’ve has 2x arrival+ the last 2+ years. last one was closed 10 months ago, applied today auto declined, called recon, reason to many accts last 24 months. I am 7 inquires and 10 accounts las 24 months. reported on my credit report immediately, will try for business aviator to avoid a wasted hard pull.

DP: Got denied for Barclay Arrival + @ 6/24. Got the mail with denial reason as too many open accounts. But today I got a targeted offer for 40,000 miles, application deadline, early November. Thinking of applying. Will update if I apply and it gets approved.

app and approved on 9/19 and already got an alert from EX today 9/21! wow, barclaycard reports fast!

*possibly reported to TU and EQ also.

40K now https://home.barclaycardus.com/cards/barclaycard-arrival-plus-world-elite-mastercard.html

Thanks, updated post.

Wife applied last week and approved at 5/24, 4/12, 2/6. So 6 rule not contradicted; i.e. 5/24 still works.

At 11:30 Pacific time I found the link in this post to lead to an offer expired notice, however at 11:45 PT the Barclays website page still had A+ listed and I completed an application. I’m about 1/6 3/12, 6/24, and one inquiry for a cc processing service, before this card, so I guess I’m an excellent test. FICO 820-830, changes if I pay cards before or after cycle end.

Since Barclays pulls TU, aren’t we actually interested in people’s X/24 on TU, not overall??

All links seem to cycle to expired offer at this point.

Bugger- got denied in a letter due to not applying in time. Recon stuck with their ET, as they are based in Delaware. No credit pull.

>> Since Barclays pulls TU, aren’t we actually interested in people’s X/24 on TU, not overall??

not really. x/6, x/12, x/24 are related to all NEW ACCOUNTS that how up on your report. some banks dont report to all three but most do. so it doesnt matter TU or not. a new account will show up and thats whats critical. barclays will see all ur new accounts. altho its possible TU has less new accounts than other CRAs because a bank didnt report to TU, but thats rare.

Thank you NinjaX for this important education!!

I stand corrected. I just saw it still on the main CC page, but I now see what “cm” above sees.

2017-09-20T00:30 MT — offer seems to be expired. The landing page still works, still showing 50k, but clicking the apply button Apply Now button doesn’t produce the application form no more, but instead says:

«

Barclaycard

Thank you for your interest in a Barclaycard Arrival Plus Mastercard.

Unfortunately, this offer has expired.

We apologize for this inconvenience.

Please click here to check out current offers.

»

However, doing the “click here”, it brings you to their page with a list of all the cards, and the A+ @ 50k is still there (not sure if it even was before), however, following the links to apply, gives the same message again.

2017-09-20T00:30 MT — offer seems to be expired. The landing page still works, still showing 50k, but clicking the apply button Apply Now button doesn’t produce the application form no more, but instead says:

<>

However, doing the “click here”, it brings you to their page with a list of all the cards, and the A+ @ 50k is still there (not sure if it even was before), however, following the links to apply, gives the same message again.

You say “Update 9/18/17: According to DansDeals this offer will end tomorrow…” but when you click on the link “DansDeals” it says

“Ooops… Error 404

Sorry! The page you are looking for does not exist.”

Also, it looks like the offer hasn’t ended yet.