Deal has expired, view more business checking bonuses here.

Offer at a glance

- Maximum bonus amount: $1,000

- Availability: Nationwide

- Direct deposit required: No

- Additional requirements: Deposit $2,500 & maintain it for 60 days. Complete five qualifying transactions

- Hard/soft pull: Soft

- ChexSystems:No

- Credit card funding: Not available when opening in branch

- Monthly fees: $15, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: One

- Expiration date: April 16th, 2020

Contents

The Offer

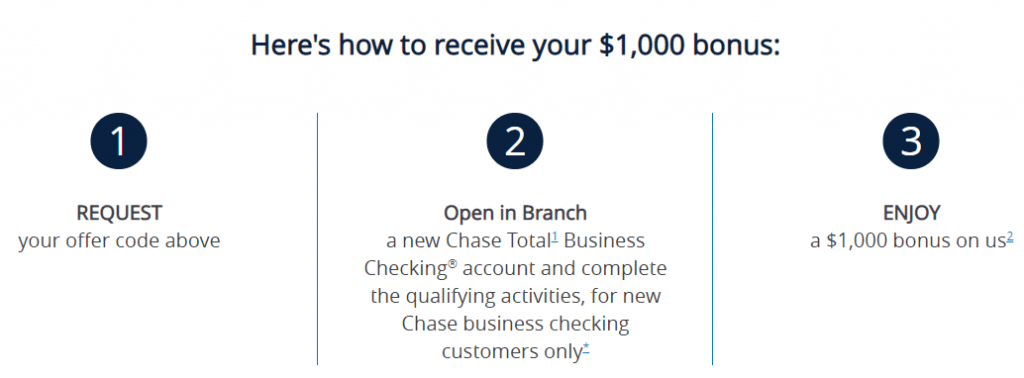

- Chase is offering existing Chase Private Client customers a bonus of $1,000 when they open a new Chase total business checking account and complete the following requirements:

- Deposit a total of $2,500 in new money within 20 business days of account opening

- Maintain that balance for 60 days

- Complete 5 qualifying transactions within 60 days of account opening

The Fine Print

- Checking offer is not available to existing Chase business checking customers, local, state or federal Government entities or agencies, Not for Profit organizations, Political Action Committees, or those with campaign accounts, or whose accounts have been closed within 90 days or closed with a negative balance.

- To receive the business checking bonus:

- 1) Open a new Chase Total Business Checking®, Chase Performance Business Checking® (or Chase Performance Business Checking® with Interest) account or Chase Platinum Business CheckingSM account, which is subject to approval;

- 2) Deposit a total of $2,500 or more in new money into your new checking account within 20 business days of account opening; and

- 3) Maintain at least $2,500 balance for 60 days from the date of deposit. The new money cannot be funds held by your business at Chase or its affiliates.

- 4) Complete 5 qualifying transactions within 60 days—debit card purchases, Chase QuickDepositSM, ACH (Credits), wires (Credits and Debits).

- After you have completed all the above checking requirements, we’ll deposit the bonus in your new account within 10 business days.

- You can receive only one new business checking account opening related bonus every two years from the last enrollment date and only one bonus per account.

- Employees of JPMorgan Chase Bank, N.A. and our affiliates are not eligible.

- Chase reserves the right to withdraw this offer at any time without notice.

- Bonuses are considered interest and may be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Chase Total Business Checking has no monthly fee when you maintain a daily minimum balance of $1,500 or more. Otherwise a $15 Monthly Service Fee will apply ($12 Monthly Service Fee when enrolled in Paperless Statements). This is the easiest account to keep fee free.

Other ways to waive the fee: if you maintain a linked Chase Private Client Checking or Chase Premier Platinum Checking personal account or if you are military/veteran. Reports indicate that Chase usually waives the fee for the first couple months.

Early Account Termination Fee

Accounts need to be kept open for a minimum of six months; otherwise, the bonus will be forfeited.

Our Verdict

Now the real question is if they actually enforce being a Chase Private Client, my guess is that they will but we won’t know for sure until somebody actually tries. You can currently get a bonus of $2,000 by becoming a private client. The standard business checking bonus from Chase is $500 and that is currently available. I will add this to the list of the best business checking bonuses, but only as footnote to that $500 bonus.

Hat tip to reader Patrick

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times