Bonus is no longer being offered. Click here to view the best current bank account bonuses.

Update 7/13/19: Deal is back and available until August 31st, 2019. Bonus has been increased to $300

Bonus is back and available until October 31st, 2018. Hat tip to reader Toad.

Offer at a glance

- Maximum bonus amount: $300

- Availability: Must live, work, attend school or worship in Michigan

- Direct deposit required: Yes, $1,000+

- Additional requirements: Make 10 debit card transactions

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Up to $600

- Monthly fees: $6, avoidable

- Early account termination fee: $5, 90 days

- Household limit: None

- Expiration date:

August 25th, 2018 October 31st, 2018August 31st, 2019

Contents

The Offer

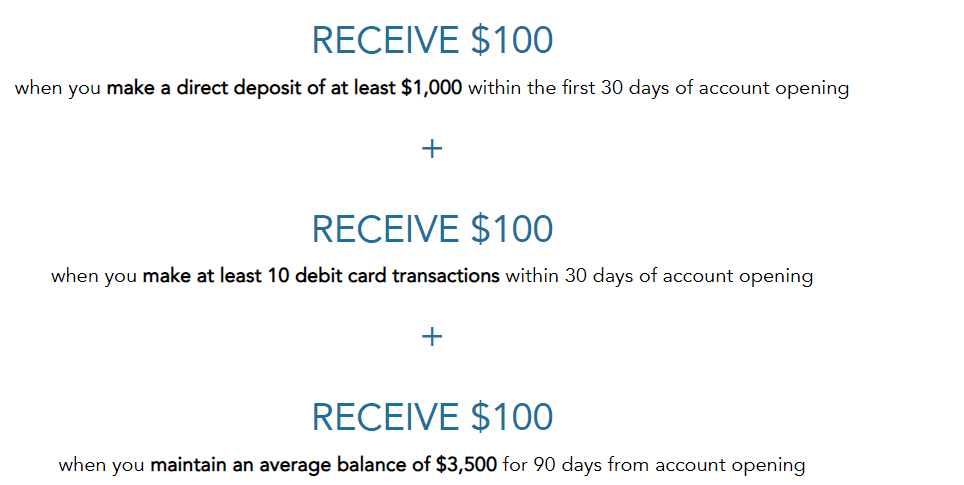

- Credit Union One is offering a bonus of $300 when you open a new cash back checking account. Bonus is broken down as follows:

- eStatements are required

- Receive a direct deposit of at least $1,000 within 60 days of account opening and receive a $100 bonus

- Make 10 debit card transactions within 60 days of account opening and receive a $100 bonus

- Maintain an average balance of $3,500 for 90 days after account opening and receive a $100 bonus

The Fine Print

- Direct deposit must be new and not currently with Credit Union ONE and post to account within 60 daysof account opening.

- Debit card transactions must post to the account within 60 days of account opening.

- ATM transactions not eligible. Funds will be credited to account within seven days after eligibility requirements have been met.

- Must subscribe to E-Statements.

- Member is responsible for any tax liability associated with cash back.

- Cash back will be reported on applicable 1099 IRS form as required by law.

- May not be combined with any other offer and is limited to one offer per member.

- Offer does not apply to members who have an existing checking account or have closed a checking account within the past six months.

- Offers expire 10/31/18.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Monthly fee of $6 is waived if you do any of the following:

- Have an average monthly balance of $500

- Receive a monthly direct deposit

- Make 15 debit card or bill pay transactions

- If you are under 24 or older than 65

Early Account Termination Fee

A $5 fee is charged if the account is closed within the first 90 days of being opened.

Our Verdict

Should be worth doing for most people as it’s a soft pull to open and there is a small amount of credit card funding. You do need to deposit $500 to keep the account fee free (or do one of the other methods) and it does require a direct deposit but at least the bonus itself is $200 and bigger than a lot of others. Because of this we will be adding it to the best checking bonuses.

Big thanks to reader, Aaron W who let us know. Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times