Update 11/14/22: Rate increased to 6%. Hat tip to Philip

Update 8/30/22: Now accepting new applicants.

[Update 7/29/19: Readers tell us that the bank has said this product will no longer be available for new signups after Wednesday, July 31st. Bankers are advising anyone who is interested to signup now.]

Reposting as it’s now confirmed to be a soft pull, just make sure to opt out of overdraft protection.

Offer at a glance

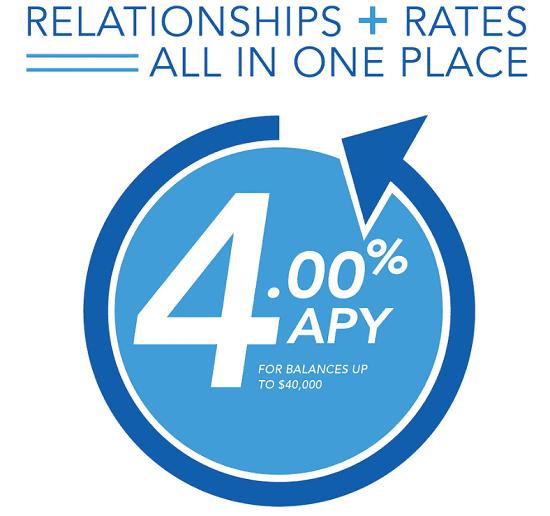

- Interest Rate: 4% APY

- Minimum Balance: $0 ($4,000 to avoid the monthly fee)

- Maximum Balance: $40,000

- Availability: Looks like you need to open in branch, all branches are in TX, MS, & LA [Branch locations]

- Direct deposit required: No, but does require an ACH debit or credit

- Additional requirements: 16 debit card transactions, eStatements

- Hard/soft pull: Soft pull

- ChexSystems: Unknown

- Credit card funding: Unknown

- Monthly fees:$14, avoidable

- Insured: FDIC

The Offer

- Origin Bank is offering 4% APY on balances up to $40,000 on the performance checking account when the following requirements are met:

- 16 posted (point of sale or signature based) debit card transactions per qualification cycle

- 1 ACH debit or credit per qualification cycle

- Receive monthly eStatements

The Fine Print

- You must have 16 posted (POS or signature based, not ATM) debit card transactions per qualification cycle, make 1 ACH debit or credit per qualification cycle, and receive a monthly eStatement on this account or the APY paid on your entire balance will be 0.00%. These monthly requirements must be completed 3 days prior to the end of your statement cycle.

- Rate may change on or after June 30, 2020.

- A service charge of $14 will be imposed every statement cycle that the average daily balance falls below $4,000.

- Limited to one account per individual.

- Closing this account within 90 days of opening results in $25 fee.

- If you originate a mortgage loan with Origin during the life of this account you will receive a $100 lender credit to be redeemed at the time of your closing; there is no minimum balance required for this benefit.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

This account has a $14 monthly service fee if the average daily balance falls below $4,000. There is also an early account termination fee of $25 if the account is closed within 90 days.

Our Verdict

This seems to be a really good deal, no direct deposit is require with an ACH credit or debit working. If you had the full balance of $40,000 in there, you could just debit the interest that puts you over that threshold. The debit card transaction requirement is a bit more difficult considering that 16 per month are required, but there are a few creative work arounds to make that easier. Overall this seems like a very strong account, keep in mind the monthly fees and the fact that the rate may change on or after June 30th, 2020. We will be adding this to our list of the best high yield accounts.

Hat tip to readers Jordan L & NN

Looks like interest definitely decreased for December! I never received any notice on this. Interest is posted now. Looks like around $166 for 40K.

Rate reduced to 5.00% APY as of 12/1/2024.

For existing accounts as well? Where did you get this information? I noticed that new account promo ad is showing 5%, but not sure if existing accounts are also affected.

Check last months statement rate. Mine was down to 5.7%, with no notice. So I bet yes, this month will be 5%.

It seems the promo rate ended now. The Feb 2024 interest has not been posted as of March 2.

Mine posted 2/29

Mine posted on 2/29 too. My February bank statement states that the interest I earned which was $185.60 is equivalent to an APY of 6.02%.

Is there a guaranteed duration on the 6% rate?

Unfortunately, there is no guarantee as to the duration. I asked that same question when I opened my account in January of this year. That’s what the bank rep told me.

Does require opening in a branch

I signed up for this bank and am still trying the POS method, they have some unadvertised benefits like ATM fee reversals similar to schwab/fidelity, albeit on a checking account. Their mobile app is lacking though, significantly lacking.

Good to know. I was wondering because their site does not mention being part of any ATM networks.

The mobile app is a POS. Constant 2 factor authorization (even after Remember Me), always having to “Skip” or “Later” a feature they want to push, and most importantly, no pending transactions after spending on the debit card, no Contact Us hyperlink to a phone number, nothing good. They also refuse to waive fees as a one-time courtesy.

POS is actually being generous

DP – I’ve usually found that banks are willing to waive the monthly charge as a first time courtesy. Origin, however, is ruthless. Got charged the $14 and they refused to waive it; they made it a big deal that they were willing to refund me half at $7. It’s laughable and very penny pinching of a bank. (Btw, I shouldn’t have been charged the $14 so I had a legit reason to dispute it)

I’ve been with Origin for 3 months now and everything has been really smooth. The POS are pretty easy to do. I’ve been able to make small charges paying off insurance at USAA and Atmos Gas and then do small charges at grocery stores. Statements are usually ready the 1st day of the month. Just have to remember that your qualifications need to be finished at least 3 days before the end of the month. The website tells you what date they need to be done and tells you how many you have towards your qualifications. Oh Yikes just remembered I need an ACH for this month simple to do–pay a credit card. I would highly recommend this bank–mainly because of the 6% interest on 40K. I start doing the POS/debit card purchases on the last day of the prior month and then they start posting on the 1st of month. 9 out of 16 set up already for Feb.

“The website tells you what date they need to be done and tells you how many you have towards your qualifications.”

Could you point to me where on their website can we find this piece of information? TIA.

At the top of the screen, click on the tab marked “Accounts” then select the link marked “Banking Benefits.”

I called the Las Colinas banking center to open this account. They offered to do everything else online but said I would still need to go in-branch to verify my ID. Since I had an Origin mortgage in the past (~7 years ago), they were able to look up my profile and just do everything online without needing a branch visit.