Update 4/24/19: Bonus has been increased to $150 after $200 in spend.

Update: This card now comes with a $100 bonus after $200 in spend within the first 40 days. Hat tip to nitpickyCorrections

This is the second post in our new So-So Sunday series*, in which we highlight unknown or lesser known credit cards, similar to Weird Wednesday – except the cards are so-so and not likely to be useful.

* originally Meh Monday; direct all adulation for the rechristening of this series to reader Ben.

Contents

Card Basics

Benefits

- 5¢ per gallon discount when redeeming 100 fuel points

- No annual fee

- Standard Visa benefits, likely Visa Basic

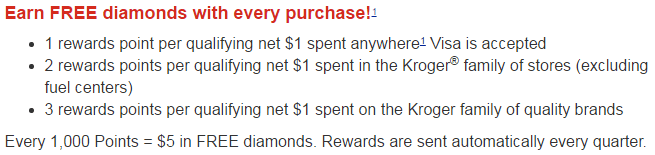

Earning Structure

- 3x on Kroger family brands

- 2x at Kroger family stores, excluding fuel centers

- 1x on all other purchases, excluding fuel centers

- 0x at Kroger family fuel centers

- (Refer to the terms and conditions for a complete list of what counts as Kroger family brands or Kroger family stores.)

Signup Bonus

- 25¢ per gallon discount when redeeming at least 100 fuel points, for the first year

- There are a few suburls of 123rewardscard.com with statement credit offers, including this link for a $75 statement credit after your first purchase (expires April 30, 2017) (thanks to reader Robert D). Your local Kroger may have different offers.

Pricing Details

APRs

- Purchase & Balance Transfer APR: 14.74% to 24.74%*, based on your credit worthiness

- Cash Advance APR: 25.99%*

- Penalty APR: None

- Grace period: 24 days (minimum, up to 30 days)

- Minimum interest charge: $2

* Note: these rates vary based on the Prime Rate.

Fees

- Balance transfer fee: Either $10 or 4% of the transfer, whichever is greater

- Cash & Convenience check advance fee: Either $10 or 4% of the transfer, whichever is greater

- Cash equivalent advance fee: Either $20 or 4% of the transfer, whichever is greater

- Foreign transaction fee: 2.8%

- Late payment fee: Up to $37

- Return payment fee: Up to $35

- Over the limit fee: None

Application Information

There are only 3 even semi-recent DPs on CreditBoards. Feel free to add any information in the comments at the end of this review!

What Credit Score Is Required

Credit scores of 659, 681, and 720 were approved.

What Credit Bureau Does US Bank Pull?

Depends on your state; reference this post.

What Credit Limit Will I Receive?

Credit limits of $1,000; $1,000; and $4,000 were given.

Rewards Program

Terrible. 1,000 points is $5, which means this card earns 1–2–3 points at 0.5 ¢ per point. I guess US Bank & Kroger decided that the 1–2–3 REWARDS Visa was much catchier than the 0.5–1–1.5 REWARDS Visa.

As far as redemption goes, you’re automatically sent a 1–2–3 REWARDS certificate every quarter if you have 1,000+ points. Certificates can be used at any Kroger family store, and are awarded no less frequently than 4 times per year (so they may come more often).

The fuel discount of 25¢ per gallon (first-year cardholders) or 5¢ per gallon (subsequent-year cardholders) requires you to scan your 1–2–3 REWARDS Visa, redeem at least 100 fuel points, and pay with your 1–2–3 REWARDS Visa. The discount is once per redemption, so you do not earn multiple 25¢ (or 5¢) discounts for redeeming multiples of 100 fuel points at once.

Why’s It So-So?

This card does not have anything going for it except the signup bonus, which is not that great.

There are tens and tens of credit cards that offer at least 2% at all grocery stores, and there are hundreds that offer at least 1% everywhere—and most of them allow you to cash out directly instead of needing to redeem a certificate at Kroger family stores. (Hot tip: it is bad if your credit card compares unfavorably with a 1% cash back card.)

The 25¢ per gallon fuel discount is nice, and Kroger generally has good fuel prices (in my experience and excluding wholesale clubs). The requirement that you redeem at least 100 fuel points is needlessly onerous*, but that’s not a dealbreaker. Given current fuel prices, 25¢ per gallon caps out at around a 12.5% discount ($2.00 per gallon). If I am reading the terms & conditions correctly, though, you never earn points for buying gas at a Kroger fuel center, which (if true) is just bizarre considering the presence of a 0.5% cashback tier.

A $75 statement credit for a single purchase is also nice. Combined with the fuel discount, I could be convinced that there is someone out there who would be served by getting this card for the signup bonus.

* especially if you accidentally use fuel points that are supposed to be available next month because Kroger automatically shows you next month’s fuel points if that balance is higher than your current one.

There is one fascinating quirk to this card, though: the Kroger family of stores includes Fred Meyer Jewelers, Littman Jewelers, and Barclay Jewelers! The marketing genius behind “Earn FREE groceries with every qualifying purchase!” missed the opportunity of a lifetime: “Earn FREE diamonds** with every purchase!”

** or, you know, not diamonds due to the ethical quagmire and rapid depreciation, but I digress.

Questions, comments, etc.? Drop them below.

We could save $3-400 annually on gas with the current sign up bonus of 55 cents off per gallon first year. I don’t see any limitation language on the bonus, anyone have any experience with churning first year bonuses on the Kroger family of cards?

Things have changed since I got the Fry’s branded card…..while the rewards are still terrible, the bonus signup was $200 with 12 months interest free. Those 2 along with the 14% APR were all I needed.

As someone who has this card, I can confirm that this is true – no points are earned when purchasing fuel at Kroger fuel stations:

If I am reading the terms & conditions correctly, though, you never earn points for buying gas at a Kroger fuel center, which (if true) is just bizarre considering the presence of a 0.5% cashback tier.

Here is a new version with 55¢ off per gallon but no SUB:

“An additional 55¢ off per gallon for ONE YEAR each time you redeem at least 100 fuel points at Smiths Fuel Centers.”

https://www.smithsmastercard.com/credit/offer.do?redirect=33888&lang=en

The offer has expired. I don’t see any sign on bonus.

Still getting targeted offers by mail for the Smith’s version with $100 statement credit & $.25/gal.

Unfortunately the better in-store offer of $200 groceries + $.50/gal has vanished.

I would have grabbed that if there was any evidence the discount would stack with 1000 fuel points for $1.50/gal (or $1.25 with the $.25 offer). But the language is suspicious and we still have no DPs.

I was going to apply but it requires a “shoppers card number” which I don’t have, does anyone knows where can I get it from? TIA

Thank you so much for the info!!!

Bonus posted as soon as $200 in charges cleared. This was easy peasy and a killer ROI. Thx, Kroger/US Bank!

This was a great bonus, $150 bonus posted within 2 weeks of activating card and spending $200. I would recommend it just for ease and $150 for only $200 spend.

This card seems to be targeted and they would not payout if someone else uses it? Has anyone had any luck?

It pays out.

Does anyone know if you can get $1.25 off fuel when redeeming 1,000 points with this card?