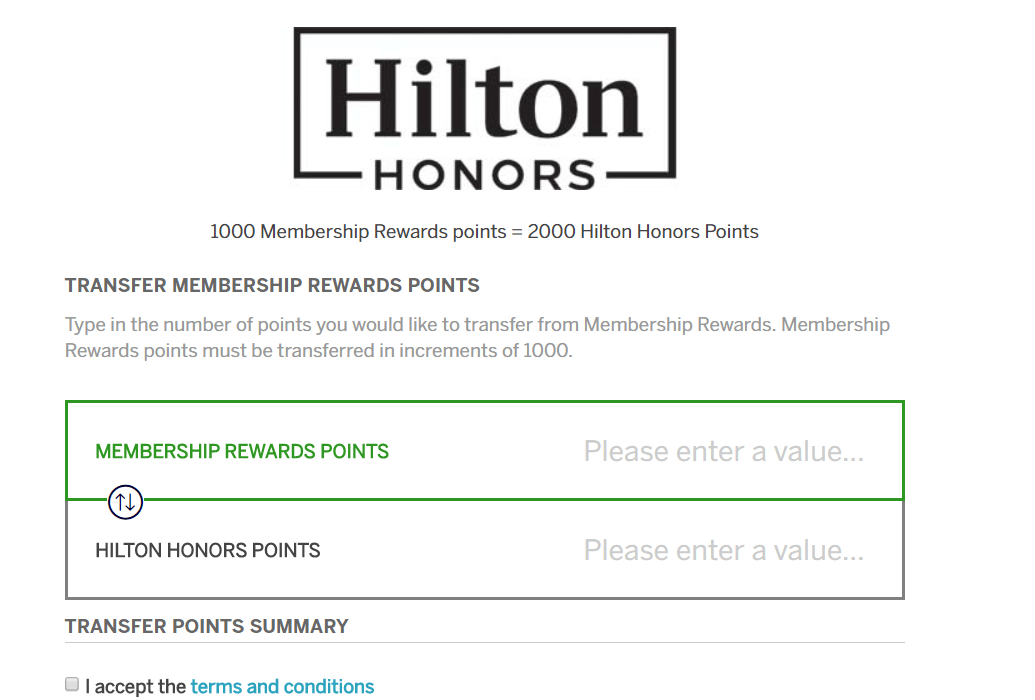

American Express has increased the transfer rate you receive when transferring Membership Rewards points to Hilton. Previously you would receive 1.5 Hilton points for every 1 Membership Rewards point transferred, effectively immediately you’ll receive 2 Hilton points for every 1 Membership Rewards point transferred. We’ve seen transfer bonuses from American Express in the past that offered this rate, so it will be interesting to see if American Express continues to offer transfer bonuses or not. If they offered the same 33% bonus then this would become 1:2.66.

Personally I don’t find Hilton points very valuable and would much prefer 1 Membership Rewards point to 2 or even 2.66 Hilton points. This is most likely part of American Express becoming the sole issuer of Hilton credit cards. They will be launching the new business & $450 annual fee Aspire card soon as well. Hopefully this isn’t a sign of a devaluation incoming, or if it is hopefully it isn’t as bad as the IHG devaluation.

Hat tip to The Points Guy

Getting plans ready to attend a family wedding, a can’t miss for my DH and 2 of my 3 children in July in Newport. HH points will get us into a Hampton Inn close enough to venue for two nights during summer high season.

Not rubbish for this family. As for the 2:1 transfer, hey, we’ll take it.

You can’t devalue something that’s already rubbish. Well I’m sure they’ll figure out a way anyway.

To say that they are rubbish is just closed minded. For some people there is great value in any program…if there was no value at all the program would not exist. If it doesn’t fit your needs or get you your 10 cents per point don’t use it. But for some this has great value!!

Still terrible value anyway.

so are the Amex MRs in my experience. transferring to airlines does not work for families, we cannot have enough to fly business class, amex travel prices at about 0.7cpp, 1MR:1c gift cards for resale yields about 0.8cpp. At least these HHs look like 0.4 to 0.6 in the areas where i take my family. Anyone know if HH charges resort fees for points bookings? If they don’t what would be more than 0.6cpp. Time to get all of the Hilton cards around, I have not started yet. Which Hilton card do i get first?

So far non of the hiltons I booked under points charged resort fees when a paid booking would require it.

I agree with you about Amex MR points! I know plenty of people have great uses for them, but UR points work much better for my use (Southwest, Hyatt, 1.5c/point for travel with CSR) and I like that I’ll always have the option to cash them out at 1c each. And I find Hilton points equally disappointing.

Chase Ur forever ♡♡♡.

Usb altitude was giving me hopes about being better, until i understood i cannot do partial payments with them.

Holding on to all my chase stuff and earn/burn mode for all else.

I don’t understand this attitude. I don’t find anywhere SW flies to be appealing unless I’m missing something. They’re ideal for the racist parts of the US, right? MR has great partners for Australia, Asia, Europe, Canada and South America. In fact MR has like 10 more partner airlines than UR.

The best thing about UR that MR doesn’t have is Hyatt.

Definitely depends on where you’re located and whether you have kids. We’re a family of 4, and Southwest has been amazing for me because I’m near BWI airport so we can fly nonstop across the country (SEA, OAK, SAN, LAS and others) utilize our companion pass, get free checked bags, book speculative vacations and cancel with no penalty, and rebook award flights when the prices drop. If I weren’t near a hub city and were single, I’m sure Southwest would be way less appealing.

Also, we mainly amass points from CC signups, and that seems easier to do with UR (especially because my wife and I can pool our points). There’s no once per lifetime language on Chase cards, annual fees are almost always waived the first year (even on large Ink bonuses). In the case of CSR, I like that the annual fee is partially offset by automatic credits that can be used broadly instead of choosing an airline to use them with. We get around 5/24 by taking turns applying to lots of cards, although it’s obviously more difficult than before 5/24. Freedom 5x categories also help us keep our UR balance topped off.

Just recently I was considering opening a Platinum card, but could only find a 60k point link, and even with triple dipping the travel credit it didn’t seem worthwhile, largely because of the $550 annual fee, $5k minimum spend and fear of Amex’s RAT. I know I’m in the minority here because MR points are very popular, but hey, to each his own.

Do as I do, and get the Charles Schwab Platinum card (as recommended by DoC in December). You’ll always have a 1.25 redemption value guarantee!

After the initial bonus, seems hard to justify the $550 annual fee though.

It’s an awesome metal card. Also, I got it in December. Received my airline credit twice so far, so I’m currently down $150. When January 2019 rolls around, I’ll be $50 in the black- and that still doesn’t account for the $100 GE credit I’ve used, the incredible expanded lounge access worldwide, the $250 in Uber credits I’ve got before I cancel in January, the awesome metalness of the metal card, the host of other bennies, and to top it off, the 60,000 MR points (now worth a minimum of $750) I’ll get for my signup bonus after 5k in spend. Pretty sweet deal, any way you look at it!

Even on year one. To much spend required for little difference between bonus and annual fee. All the perks are not useful to families. The only strategy would be get the schwab plat, transfer whatever mr you have accumulated and cancel immediately. Get the fee back and dont worry about the bonus.

Did I mention the card is silver colored metal?