- Hard/soft pull: Soft

- Credit card funding: Credit card funding is no longer available

- Monthly fees: $10-$30 (avoidable)

- Early account termination fee: $0

- Expiration date: March 31st, 2016

Contents

- 1 The Offer

- 2 50,000 American Airlines Offer

- 3 40,000 Citi ThankYou Offer

- 4 Avoiding Fees

- 5 F.A.Q’s

- 5.1 Can The ThankYou Points Be Transferred To Travel Partners?

- 5.2 Do I Have To Pay Taxes On These Bonuses?

- 5.3 What’s The Best Way To Fund With A Credit Card?

- 5.4 Can I Cancel My Citi Gold Account After Receiving the Miles/Points?

- 5.5 Can I Use These The Citi ThankYou Points To Pay For Airfare?

- 5.6 Which Is The Better Offer?

- 6 Our Verdict

The Offer

Citi has again released great offers for their checking accounts, you can now get 50,000 American Airline miles or 40,000 Citi ThankYou points when opening a new Citigold checking account. At the end of last year, it was possible to get 50,000 Thank You Points so the ThankYou offer isn’t the best ever – but it’s still very good.

Citi just now sent out these offers again to many people via email; the 50k AAdavantage offer and the 40k ThankYou offer. We don’t yet have the code for the ThankYou offer, but thanks to Bury on Saverocity Forums and jpoysti on Reddit we have the code for the AAdvantage offer. I’m hopeful that we’ll find out the ThankYou code soon, and we’ll add it to the post.

As always, these bonuses are meant to be for those who received the communication, but it usually works for anyone in that they’ll apply bonus for accounts opened with the correct offer codes upon request.

We recommend calling in to apply over the phone at 1-800-374-9500 so as to confirm that you are eligible for this offer; that way, there won’t be any doubt that you’ll get the bonus.

50,000 American Airlines Offer

Direct link to offer Use promotional code: WD3QFS2Y4C. (thanks to reader Avrohom K)

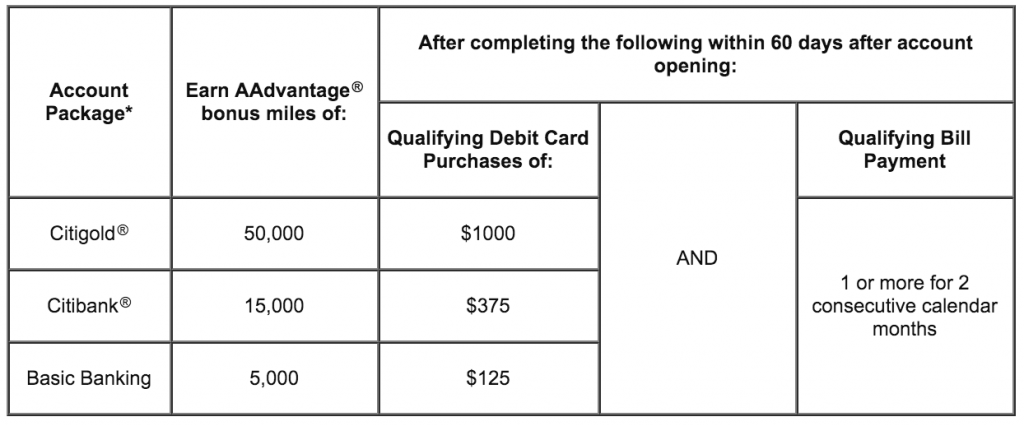

AAdvantage credit card holders can signup for a Citi checking account and receive a bonus of up to 50,000 American Airline miles. Bonus is broken down as follows:

- 50k AAdvantage miles for Citigold checking

- 15k AAdvantage miles for Citibank checking

- 5k AAdvantage miles for Basic checking

Requirements

For the AAdvantage bonus, you need to do two requirements:

- Make $1,000 in debit card purchases

- Make 1 or more bill payments for two consecutive months

Both requirements must be fulfilled within 60-days of account opening.

40,000 Citi ThankYou Offer

Direct link to offer Use promotional code: 4368UUP5L4 (thanks to reader umc for the correct code)

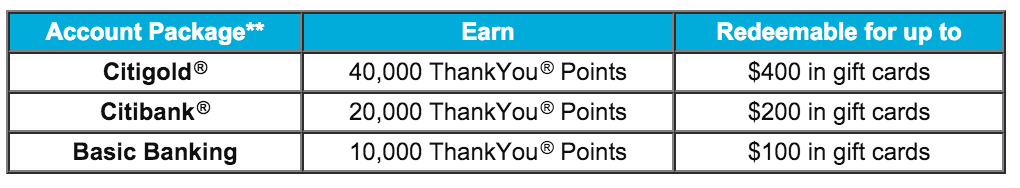

Citi ThankYou credit card holders can signup for a Citi checking will receive a bonus of up to 40,000 Citi ThankYou points when opening a checking account package. Bonus is broken down as follows:

- 40k ThankYou points for Citigold checking

- 20k ThankYou points for Citibank checking

- 10k ThankYou points for Basic checking

Requirements

For the ThankYou bonus, you need to make 1 or more bill payments for two consecutive months. Requirement must be fulfilled within 60-days of account opening.

Avoiding Fees

All of the Citibank accounts waive the monthly service fee for the first two months. After that, you need to complete a set of requirements to keep them fee free.

Citigold Account Package $30 Monthly Fee

To avoid the $30 monthly fee you need to complete one of the following:

- $50,000 in combined link deposit or retirement accounts

- $100,000 in all linked deposit, retirement, credit or investment accounts (excluding a first mortgage with citibank)

- $250,000 including linked Citibank mortgages

Citibank account Package $20 Monthly Fee

To avoid the $20 monthly fee, you need to have a combined average balance of $15,000 or more.

Basic Banking $10 Monthly Fee

Make a direct deposit (the following methods count as direct deposit, click to view) and 1 bill payment each month or keep an average balance of at least $1,500 in the previous calendar month to avoid the monthly fee.

Early Account Termination Fee $0

We couldn’t find any mention of any EATF in the product disclosures and haven’t heard of anybody being hit with a fee. Your account does need to be open for the miles to post, though.

F.A.Q’s

Can The ThankYou Points Be Transferred To Travel Partners?

No, this is from the fine print:

“Taxable Points” are Points received for a Citibank checking relationship, Points obtained through activity unrelated to purchases made with your eligible Card Account, as well as bonus Points that may be awarded with no spend requirement. Taxable Points and Points made unavailable for redemption due to signs of fraud, abuse or suspicious activity on your ThankYou Account or due to your failure to make the required minimum payment on the Card Account by the payment due date are not eligible for Points Transfer. (HT to Anthony)

Do I Have To Pay Taxes On These Bonuses?

Legally, all bank account bonuses are treated as interest and as such you should pay taxes on them. The real question most people want the answer to is: will Citi send out a 1099-INT form for these bonuses? You can read our more in-depth answer to this question here.

What’s The Best Way To Fund With A Credit Card?

Update: Credit card funding is no longer available on these accounts.

Funding online doesn’t work, you need to do it via phone or fax. Read our walk through here.

Can I Cancel My Citi Gold Account After Receiving the Miles/Points?

Yes, you can. There is no early account termination fee or requirement to keep the account open after you’ve received the bonus.

Can I Use These The Citi ThankYou Points To Pay For Airfare?

Yes, you can. And if you have the Citi Prestige you’ll get 1.6¢ in value per point for American Airlines/US Airways flights. If you redeemed all 40,000 points for this you’d receive $640 in value which would put you over the $600 limit causing Citi to issue a 1099-MISC. This screenshot again supplied by Kenny from Miles4more shows he is able to use points earned from this bonus for that purpose.

Which Is The Better Offer?

What’s worth more to you, 40k non-transferable ThankYou points or 50k American Airline miles? Everybody will have a different answer depending on your travel goals.

Our Verdict

We wrote up a detailed walk-through of these bonuses in the post: Step-by-Step Guide to Citigold 50,000 Points Checking Bonus. If you have any questions about these bonuses that weren’t covered in this post, you’ll likely find it there.

These are both amazing deals, although the ThankYou one has been higher in the past. The credit card funding makes this especially worthwhile, and it can help meet a minimum spend requirement.

Also, remember, that when you also consider that having a Citi Gold checking account will lower the annual fee on the Citi Prestige by $100, and if you already have the card it will be prorated based on how long you’ve had the card for.

We’ve also discussed other benefits of having these accounts in the newsletter.

Just received one for 50,000 aadvantage for Citi Priority. I’m a long time regular Citibank checking/savings account member and picked AA personal and biz cards this year. Looks like $30 fee if under $50,000. Looks like also offers 5000 for basic, 30,000 for regular, and 60,000 for Gold.

As a weird DP, I had my citigold checking open for 5 months and never got charged the monthly fee even though I only had $60 in the account. I was expecting $30 fees.

I just got this 50k thankyou points offer in mailbox today.

Does anyone know if they will receive 1099-INT forms for the points they receive from this bank signup bonus? I wonder how do they calculate how much is taxable? Anyone have any experience? Still waiting for my 1099 form if they ever do send one out.

Actually, I just found out that you don’t get a form until you actually use the points.

I would like to contact Barclays to reconsider my CC application: what is the phone number r to call.Your reply will be highly appreciated

Citigold customer service is horrible. It is as if Citibank does not value customer relationship nor money. I will likely never do business with them. I signed up online for the promotion offer of 50k aa miles back in December 2015. I called them to confirmed my account was opened and qualify for the promotion. I followed the promotion with 1k in debit purchase and a bill payment in the 1st 2 months. Called after meeting the qualification and was told to wait the 90 day period. After 90 days do not see promo post in my AA account. Called to open up investigation. Provided them with the promo code. Did not hear back for a week. Called back and spoke to supervisor. Was given assurances of 24-48 business hours. Nothing was done. Went to a local branch and was assured same thing. Nothing was done. A week later I went to another local branch. I was finally given a case number. Spoke to another citigold sup. who advised me to try back today. Spoke to another sup. today who said there is no time frame. The investigation could take an indefinite amount of time. To top it all off, received an email. Spoke with Citigold again. Rep. was clueless even though the email said to call them for password. Finally she got me over to a sup (after a long wait). Supervisor got me the password and the email stated that I did not qualify for the promotion since I was not “targeted”. It took about 6 months for them to let me know this when all along the process, they have strung me along. So thank you Citibank for the worst banking customer service experience ever. You have set a the level of incompetence so low that any other financial institution can easily exceed.

Had quite a similar experience, but while speaking to the last supervisor (of many) actually stated the following:

I am extremely dissatisfied with the level of service I am getting from CitiGold desk. I have spent too much of my time on the calls to the department and this is the last time I am making a call. If within a week I do not receive a call/email with the definite date on which the miles will post I am going to close CitiGold account and cancel every single credit card I have with Citi.

Actually received an email and a written letter with the date and the points posted a few weeks ago. Obviously, closed CitiGold and now looking to shift credit lines to a no-fee cards to close some of the redundant credit cards.

I signed up for the offer using the promotion code. I then sent a secure message to citibank and they confirmed that I was eligible for the promotion via email. I called them to find out when the 50,000 points would be in my account and they now sent me a letter saying that I was not specifically targeted and therefore I am not eligible. I met all the terms and conditions and they are now refusing to honor the points. What should I do?

Check this post https://www.doctorofcredit.com/get-citi-honor-citigold-checking-promotions/

“All of the Citibank accounts waive the monthly service fee for the first two months. After that, you need to complete a set of requirements to keep them fee free.”

Is this still true? I just opened a new account, but they didn’t say anything like this in the terms/

I just called citigold and they said the fees were not waived if 50,000 balance cannot be met. “Maybe your banker waived that for you, but from our standpoint, $30 fee will be charged”.

My wife and I signed up for the Citigold account online March 31st using the AA50K code. I was immediately approved, my wife was not. She still has not received any e-mail confirmation of approval.

I have the Citi Prestige and the Citi AA Platinum World Mastercard. My wife has the Prestige and a Citi AA Gold card.

Today, I noticed a $374.98 credit on both of our Prestige accounts listed as “Refund Membership Fee.” I’m not complaining if they want to give us each more than $100 back.

It appears to be a prorated refund of the entire $450 annual fee as we’ve had the Prestige for only 2 months. Although newly listed, the credit is backdated to February 19th which was the day the membership fee was charged.

Has anyone else had this happen? When something seems too good to be true, I wonder “what’s the catch?”

I opened a CitiGold account online for my wife last Saturday. How long is it taking to get the checks and Debit card these days? I am asking because it took forever and several requests to get my Debit card when I applied in November. Thanks…