Deal has expired, view the best current savings bonuses here.

Bonus back for 2018, but it still sucks. It’s actually worse than previous years due to it needing to be deposited for four months instead of three.

Update: not worth considering due to the hard pull

Bonus is back for 2017. Last year it required the balance to be maintained for six months but now it requires it to be maintained for three months.

Offer at a glance

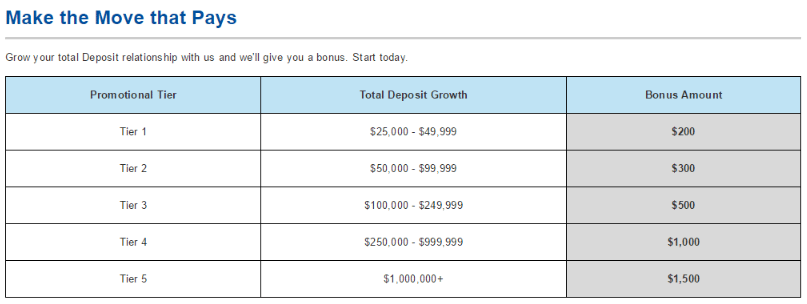

- Maximum bonus amount: $200-$1,500

- Availability: Nationwide?

- Deposited Required: $25,000-$1,000,000

- Required Length: Six months from enrollment

- APY: 0.25-0.35% APY

- Hard/soft pull: Hard

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: None

- Early account termination fee: Unknown

- Expiration date:

November 30th, 2016 November 30th, 2017October 31st, 2018

The Offer

- Sign up for the promotion (online, in branch or call them)

- They’ll add a promo code to your account

- Grow your deposit relationship with First Tech with funds from any outside financial institution over to any First Tech savings, checking or certificate account by November 30th, 2018.

- The amount of funds you move determines what tier and bonus you’re eligible for

- Maintain the minimum required total deposit growth for at least four months from the month you were enrolled

- Receive bonus by March 31st, 2019

The Fine Print

- Offer expires 11.30.17.

- Promotional Period is 08.01.17 to 11.30.17.

- Enrollment is the month the promotional code was added to your profile.

- Grow your total deposit relationship with First Tech by moving funds from any outside institution to any of your First Tech share accounts during the Promotional Period.

- New money cannot be held by First Tech or its affiliates.

- On 12.01.17, First Tech will determine how much your total deposit relationship grew during the promotional period by taking your total share balances on 07.31.17 and comparing them to your total share balances on 11.30.17. The increase in your total share balances during the promotional period will determine which Promotional Tier you are eligible to participate in.

- Your total share balances must increase by $25,000 or more during the Promotional Period. To receive a Promotional Tier Bonus, you must maintain the minimum required total deposit growth for the Promotional Tier you were eligible to participate in for at least three months from enrollment.

- If at the end of the three month period your total deposit growth drops below the Promotional Tier you were eligible to participate in, but still falls within one of the lower Promotional Tiers you’ll be paid the bonus amount for the corresponding tier. Annual percentage yield is based on current available rates. Bonus Payment:

- We’ll deposit the bonus to your Membership Savings account no later than 3.31.18.

- Bonus amount is considered interest and will be reported on IRS form 1099-INT. Rates, terms and conditions subject to change at any time.

Best Rate

You can view the rates for all the accounts here. The best rate is on their Dividend Rewards checking account (offering 1.58% APY) but that is only on balances of up to $10,000. The next best is 1% APY on the HSA checking account, but that wouldn’t be practical for most people. The other savings accounts are only 0.25%-0.35% APY depending on your balance. There is no monthly fee on this account.

Avoiding Fees

The savings accounts do not have any monthly fees, I’m unsure if there is any early account termination fee but it shouldn’t really matter as the accounts have no monthly fees.

Our Verdict

Below are the effective APY’s you’re getting from these bonuses based on holding the lowest amount necessary for each tier.

- $200 bonus: 3.2% APY for six months + 0.3% APY

- $300 bonus: 2.4% APY for six months + 0.3% APY

- $500 bonus: 2% APY for six months + 0.33% APY

- $1,000 bonus: 1.6% APY for six months + 0.35% APY

- $1,500 bonus: 0.6% APY for six months + 0.35% APY

As you can see, the more you deposit the less you get. Personally I’d recommend giving this bonus a miss and instead sign up for a straight bank account bonus instead and put your funds into a different high interest checking account.

Big thanks to reader, David who let us know. Please consider sharing bank bonuses with this site so we can make it even better.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

I just can’t imagine someone with 1 million or enough cash not buying a house instead but would be depositing into bank account for $1500 taxable bonus. Some CU/Bank’s offer just does not make any sense at all.

This bonus is back on.

https://www2.firsttechfed.com/depp-gys2018?utm_source=carousel&utm_medium=print&utm_campaign=WF41040_GYS2018_ca&campaignId=701610000004f8U&_ga=2.201714257.1186470667.1533179544-1188918714.1533179544

Would they use the same hard pull for the credit card bonus you just posted? If so, that might change your recommendation for this, correct?

If you’re doing a hard pull for the credit card anyway, why not get another $200?

No CC funding allowed

Thanks, any hard/soft pull?

Credit boards pull database says hard pull to join…..equifax/transunion used.

Thanks for the info

Mathematically, you would want to deposit 25K in each of your family member’s account to maximum the payout instead of depositing the total amount in one single slot.

In one single lot: In multiple accounts:

Tier 1 $25,000 – $49,999 $200 $200

Tier 2 $50,000 – $99,999 $300 $200 x ($50,000/$25,000)=$400

Tier 3 $100,000 – $249,999 $500 $200 x ($100,000/$25,000)=$800

Tier 4 $250,000 – $999,999 $1,000 $200 x ($250,000/$25,000)=$2000

Tier 5 $1,000,000+ $1,500 $200 x ($1,000,000/$25,000)=$8000

Always thanks for DoC articles.

The APY calculation seems not correct….it is 6 months required, not 3 months. I think the author multiplied 4. Correct me if I am wrong.

Thanks

Will, one more thing, the APY for the instant access savings went up. For $25,000-99,999.99 the APY sure now 0.30%.

Thanks, Reg. Added this to the post!

Will, the write up still says you have to keep the account open for 6 months (under the avoiding fees section).

Good catch, Reg. Updated

So I need to leave $25k in the account for 90 days for $200.

That’s not terrible, but it ain’t great, either.

The $200 bonus is really,

$200 bonus: 1.6% APY for six months + ((1.58% * 10K) + (0.25% * 15K) APY) or,

$200 bonus: 1.6% APY for six months + 0.78% APY => 2.38% APY.

Not shabby for zero risk.