Offer at a glance

- Interest Rate: 5.01% APY

- Minimum Balance: $25 to open

- Maximum Balance: $10,000

- Availability: Select Georgia counties, see below

- Direct deposit required: Yes

- Additional requirements: Yes (50 debit transactions totally $250)

- Hard/soft pull: Unknown

- Credit card funding: No (in-branch only)

- Monthly fees: None

- Insured: NCUA

The Offer

- MidSouth Community FCU of Georgia offers their iChecking account with 5.01% APY on balances up to $10,000

The caveat to the rate is that you need to do 50 debit transactions per month to be eligible for the 5% rate. Worse yet, the average debit charge needs to be $5 to be eligible. Essentially, you need to swipe the card 50 times for a combined total of $250 per month to be eligible for the top rate.

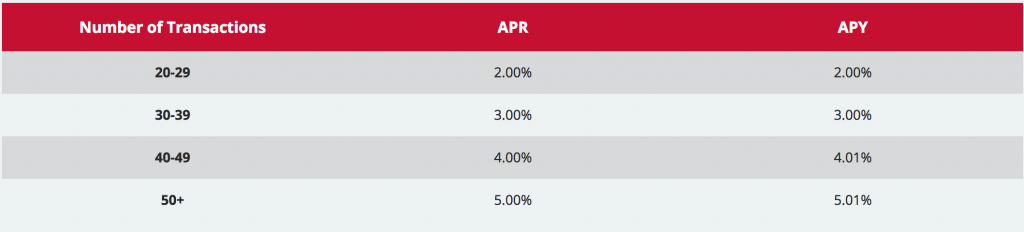

There are also lower rate tiers:

Aside from the debit requirement, there are a few other things you must do to get the rate:

- log into Home Banking at least once per month

- be enrolled in e-Statements

- maintain a valid e-mail address

- have a Direct Deposit posted to the iChecking account within the calendar month for which dividends are posted

The Fine Print

- No minimum balance

- $25 minimum to open

- Limit one (1) iChecking dividend-bearing account per membership.

- The iChecking account dividend rate is a variable rate. The dividend rate and annual percentage yield (APY) may change at any time, as determined by the Credit Union Board of Directors.

- The iChecking Annual Percentage Rate (APR) and Annual Percentage Yield (APY) is based on the number of Point of Sale (POS) transactions that post to the account during the calendar month. The minimum number of Point of Sale transactions does not include authorizations. The debit card transactions only include Point of Sale transactions that have paid on the account before the end of the month. Does not include transactions made at an ATM.

- The rates above will be paid on the average daily balance for the calendar month, up to $10,000. Any amount of the average daily balance above $10,000 will earn the current Premier Checking Account rate of .100% APR / .100% APY. Dividends are compounded monthly and credited to the account monthly.

- Checking accounts subject to credit approval.

Avoiding Fees

The account does not have any monthly fees. It even comes with 7 free ATM transactions/month (I assume that’s referring to non-affiliate ATMs, but not entirely sure).

Geographic Eligibility

The credit union is open to anyone who works, lives, worships, or attends school in these Middle Georgia counties: Bibb, Baldwin, Crawford, Hancock, Houston, Jones, Monroe, Peach, Pulaski, Putnam, Twiggs, Washington, and Wilkinson.

Account must be opened in branch.

Our Verdict

This is a pretty good deal for those in the target area. It is a hassle dealing with swiping the card 50 times, but you can simplify it by making a single large purchase of $225.50 and then 49 $.50 Amazon reloads. Or just use it regularly for your smaller transactions.

In the end you’ll lose a bit on from the credit card rewards on those $250 in spend. If we’ll figure a 2% credit card, you’ll lose $5/mo for the ~$41/mo interest earned on the $10k which lowers the earnings a bit. Overall, there’s still a healthy gain to having this account over an ordinary 1% savings account.

I like that they are clear on the requirements; Northpointe has a similar 5%/$10k deal with a debit requirement that’s a bit more vague. (The Northpointe is easier on the direct deposit front, and most importantly it’s available nationwide.)

We’ll add this to our list of Best High Yield Savings Accounts.

Hat tip to Depositaccounts

This could be done with Venmo, but they limit transaction amounts after I think 10 transactions and theres a cool off period which is irriating. Instead of being able to pop these 50 x $5 debits out in a single sitting you would have to spread them out over like a week which is a huge PITA. Amazon reloads as well as some sort of cell phone / utility bill debit option is not suitable for me.

I also would like to know has anyone done this yet? Additionally would the payment of utility bills on card count as a point of sale(POS)? Any new information/feedback on this would be greatly appreciated as I am considering an account.

Does anyone actually do this? I’d love to hear any firsthand experience with this account/CU.

This is a lot of work to earn $500 max? All that swiping and transactions takes time–depending what your hourly rate is for earnings, you could make it up in several hours–think of all the hours over the course of a year for those transactions even doing amazon 49 times.

Honestly, this seems to me to be a better alternative to Northpointe for those who qualify, if they don’t care if your 50 POS transactions are all Amazon loads (and if Amazon doesn’t mind you making 50 automatic allowance loads each month).

*I mean 49 automatic allowance loads, since you would presumably want to use one of the required transactions on a large cash-like POS transaction (Square Cash, Circle, PP etc.) to minimize opportunity cost / lost rewards.

Remember, they said “average”, which should mean that any combination of 50 transactions totaling to at least $250 within the calendar month should work.

True, noted now. Though the DD requirement is a bit harder.

That’s true, though it can probably be automated (pending DPs of which ACH transfers qualify as DDs). Whereas I wouldn’t feel comfortable automating Northpointe’s requirements anymore…

Chuck…where are you getting $2500 from? I don’t see anything on the direct link to offer.

The $5.00 minimum average transaction amount requirement is specified in the last sentence under the “MINIMUM ACCOUNT REQUIREMENTS” expandable section.

But as I mentioned above, that should mean $250, not $2500…

I was on the same page as you, just wanted to confirm with him to make sure we’re all on the same page. nice catch.

Fixed, thanks for pointing out

“The big caveat to the rate is that you need to do 50 debit transactions per month to be eligible for the 5% rate. Worse yet, the average debit charge needs to be $5 to be eligible. Essentially, you need to swipe the card 50 times for a combined total of $2,500 per month to be eligible for the top rate. ”

$5 * 50 = $250, not $2,500. Or am I missing something…?

My mistake, let me fix, thanks

My initial reaction is to start bitching about the number of debit card transactions they want you to do, but I won’t. First of all no one if forcing me to open this account and secondly at least they are being transparent with the number of transactions and total $ amount unlike Northpointe Bank that not only has hidden limits but will close your accounts if these hidden amounts are not met.

With that in mind for “me” this is not worth the number or the $ amount required.

Thanks for the great post and hope someone can benefit from this, I love these oddball deals.

50*5=250 not 2500. and I assume the cash back function is okay to trigger the requirement. So use kiosk to do cash back when buy small things or load on serve/bluebird if they still exist makes this really profitable.

Ugh, wow, that was a bad math error on my part. I’ll update the post. It’s actually not bad given the correct math.