Update 5/6/24: Extended through 9/9/24

Offer at a glance

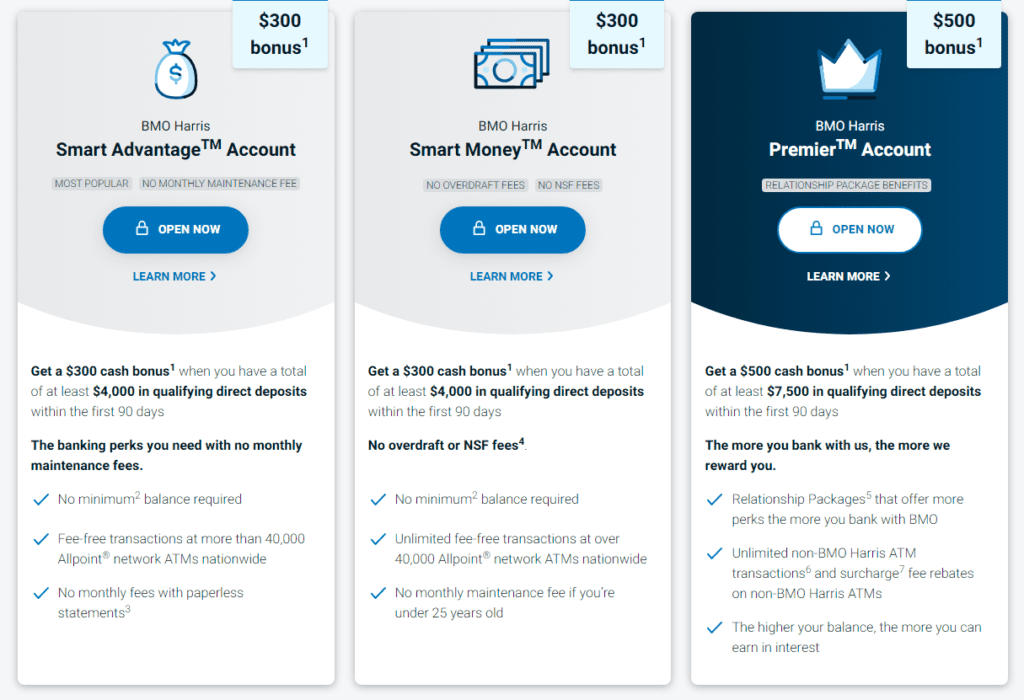

- Maximum bonus amount: $560

- Availability: Nationwide now

- Direct deposit required: Yes, direct deposits totaling $4,000+ or $7,500+

- Additional requirements: None

- Hard/soft pull: Soft

- ChexSystems: Yes

- Credit card funding: Cannot fund with a credit card

- Monthly fees: $25, avoidable

- Early account termination fee: $50 if closed within 90 days,

- Household limit: None listed

- Expiration date:

September 30th, 2020 October 31, 2020November 11, 2020January 29, 2021April 30, 2021June 3, 2022September 9, 2024

Contents

The Offer

- BMO Harris is offering a bonus of $500 when you open a checking account:

- Open a Smart Advantage Account and get a bonus of $400 when you have at least $4,000 in qualifying direct deposits within the first 120 days of account opening

- Open a BMO Harris Premier Account and get a bonus of $600 when you have at least $7,500 in qualifying direct deposits within the first 120 days of account opening

- You can also open a savings account and get $5 monthly savings bonus for each month that you save $200 or more, for up to 12 months.

Open a Platinum Money Market account and get a bonus of up to $300:Get a $100 bonus when you deposit $10,000 or more in the first 30 days and then keep it in your account for at least an additional 90 daysGet a $200 bonus when you deposit $25,000 or more in the first 30 days and then keep it in your account for at least an additional 90 daysGet a $300 bonus when you deposit $50,000 or more in the first 30 days and then keep it in your account for at least an additional 90 days

The Fine Print

- You are only eligible for one checking account cash bonus; you cannot open multiple checking accounts and receive multiple cash bonuses.

- In order to be eligible for these offers, you must reside in Illinois, Wisconsin, Minnesota, Indiana, Arizona, Kansas, or Missouri.

- You can apply online or at a branch.

- To apply online, use the “open now” links above and we’ll automatically apply the promo code for you.

- Before you apply at a branch, enter your email and click “Send Me My Coupon Above” to receive the promo code you must use when opening your account. You must open your accounts between July 1, 2020 and September 30, 2020.

- Offers A & B can be combined but each are limited to one per customer.

- Offer A is not available for existing BMO Harris personal checking customers (including signers on joint accounts) or those who have closed a BMO Harris personal checking account within the past 12 months.

- Offer B is not available for existing BMO Harris personal money market or savings customers (including signers on joint accounts) or those who have closed a BMO Harris personal money market or savings account within the past 12 months.

- Offer B is available for existing BMO Harris personal CD or IRA customers (including signers on joint accounts) and those who have closed a BMO Harris personal CD or IRA in the past 12 months.

- Bonuses are not considered part of the opening deposit and will be reported to the IRS for tax purposes.

- You are responsible for any applicable taxes.

- Offers can be changed or cancelled without notice at any time, and cannot be combined with any other offer.

- Your accounts must be open, in good standing and must have a balance greater than zero when the bonuses are paid approximately 100 days (Offer A) and 130 days (Offer B) after opening.

- Offer A: Get up to a $350 bonus when you open a new BMO Harris Smart Advantage™ Account or BMO Harris Premier™ Account and have qualifying direct deposits of a paycheck, pension payment, Social Security payment, or other government benefits payment electronically deposited into the account from an employer or outside agency. We reserve the right to request documentation to confirm that the direct deposits qualify.

- 1) Get a $200 bonus when you open a new BMO Harris Smart Advantage™ Account and have a cumulative total of $4,000 in qualifying direct deposits within 90 days of opening. OR 2) Get a $350 bonus when you open a new BMO Harris Premier™ Account and have a cumulative total of $7,500 in qualifying direct deposits within 90 days of opening.

- You are only eligible for one bonus; you cannot open both checking accounts and receive both bonuses.

- Day 1 is the day you open your account and begins the tracking period.

- If you open your account on a day other than a Business Day, Day 1 is the next Business Day.

- The checking account type you have on Day 90 will determine which bonus you are eligible for. In order to receive the bonus, you must meet the associated criteria for that account.

- Offer B: Get up to a $300 bonus when you open a new Platinum Money Market account and make qualifying deposits of new money. New money is defined as funds not currently on deposit at BMO Harris Bank or its affiliates.

- 1) Get a $100 bonus when you deposit at least $10,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $10,000 and it cannot drop below $10,000 for the next 90 days. OR 2) Get a $200 bonus when you deposit at least $25,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $25,000 and it cannot drop below $25,000 for the next 90 days. OR 3) Get a $300 bonus when you deposit at least $50,000 in new money into your account by Day 30. Beginning Day 31, your balance must be $50,000 and it cannot drop below $50,000 for the next 90 days.

- You are only eligible for the bonus amount corresponding to your account balance on Day 30.

- If your account balance increases or decreases between Day 31 and the next 90 days, you will not be eligible for a different bonus amount. Day 1 is the day you open your account and begins the tracking period. If you open your account on a day other than a Business Day, Day 1 is the next Business Day.

- Deposits received on a day other than a Business Day will be posted the next Business Day.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Smart Advantage Checking Account ($350 Bonus)

This account has no monthly fees to worry about

BMO Harris Premier Account ($350 Bonus)

This account has a $25 monthly fee. This is waived with one of the following:

- $10,000 minimum daily balance,

- $25,000 in combined balances with Relationship Waiver,

- or a BMO Harris Financial Advisors, Inc. investment account

Early Account Termination Fee

There is an early account termination fee of $50 if the account is closed within 90 days.

Our Verdict

If you’re doing the savings bonus ($200 or $300) then you’ll have enough money in combined balances to keep the Premier account fee free as well. The savings account earns 0.05% APY for balances $25,000 or under and 0.1% APY for balances $25,000+. The most recent BMO Harris offer was for $200 for opening a checking account, but has been as high as $500 with the same requirements.

This bonus is up to an extra $150 compared to that $500 bonus, but the requirements are much higher. We obviously don’t have any idea if/when that bigger bonus will return so if you can do the full $650 bonus this might be worth considering. Because of that we will add it to our list of the best bank bonuses.

Hat tip to readers JohnnyBoyJr & raekwon

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 1/10/24: Extended until 5/3/24

- Update 12/11/23: Bonus is back but now only $250/$400.

- Update 10/9/23: There is now a savings bonus as well, not worth considering due to the current high interest rates.

- Update 9/19/23: Deal is back and valid until 12/8/23 and now officially $400/$600

- Update 9/10/23: Looks like people are actually getting $400/$600.

- Update 6/21/23: Looks to be nationwide now.

- Update 5/16/23: Extended through September 15, 2023.

- Update 1/9/23: Extended through June 2, 2023.

- Update 10/6/22: Bonus is now $350, valid through 12/30/22

- Update 7/11/22: Bonus has been increased to a maximum of $560. Hat tip to reader Matt J

- Update 2/7/22: Maximum bonus is now $350.

- Update 9/27/21: Extended until October 15.

- Update 6/10/21: Deal is back and has been increased from $200/$400 to $300/$500. Valid until September 30, 2021.

- Update 2/13/21: Deal is back and valid until

4/30.May 28, 2021June 4, 2021 - Update 1/5/21: Deal is back for $350. There is also a $5 savings bonus per month for 12 months. Hat tip to reader JohnnyBoyJr

- Update 10/14/20: Deal is back for the $350 checking bonus, savings bonus is not available this time. Deal is better when savings is also offered as that is enough to keep the Premier account fee free as well. Hat tip to reader Snowbird

- Update 8/3/20: Link for FL added. Hat tip to reader Zach

Can someone give me a play-by-play how to get the higher bonus while opening the lower account and then converting?

If you scroll down and read there are detailed DP’s… Dirk

Dirk

Just remember that some DP’s will say 90 days… some will say 120…. because BMO keeps changing it.

Thank you

I have seen more than one comment like this: https://www.doctorofcredit.com/il-wi-mn-in-az-fl-ks-mo-bmo-harris-350-checking-300-savings-bonus/#comment-1789794

“Are there any DPs of people receiving a 1099 after using Chase Business Employee Pay ($2.50 fee) for satisfying DDs? Anyone from prior years? Someone on a different thread mentioned something of this happening. I can’t find any additional DPs.”

I did this method already for laurel road and planned to do it for bmo but don’t want to end up paying taxes as a ‘business owner’

As fee adverse as this community is, I think people would have been screaming bloody murder if they had to pay taxes to move money.

I am not an accountant. I do not have a Chase biz account. I do not know at what point a transfer becomes a paycheck and would require reporting to the IRS.

I would look at the annual 1099 post about this subject, and the Chase business checking post too. GL.

Alternate methods of DD at BMO would be Treasury Direct, Wise, or Novo. Dirk

Dirk

Anyone get called by them after approval? I keep getting phone calls from them asking for a call back, and I don’t wanna.

Probably just a courtesy call to check in with you… see if you have any questions.

If your login still works, debit card activated… and in/out ACH works, they have no beef.

May 8 – relationship (premier) chq acct opened

Jun 14 – Direct deposit $7500 met

still didn’t get $500 bonus. Should I be worried and contact the bank? Any DP how long does it take to see the bank bonus after the direct deposit is met?

Bonus is paid based on the date in your offer. Completing the direct deposit sooner does not speed up the bonus date.

Got it! So the bonus should be get paid 90 days after the account open date which will be around Aug 8? (opened on May 8)

Just received an offer for $600 checking bonus with 10000 in DD and $300 saving bonus with 25000 in deposit.

how did you get that offer?

Also rec’d. Have a BMO CC.

Hey how many days after DD to the chq bonus posted?

If I opened the smart advantage account, can I still open the premier account?

Ok… I’ll bite.

Why would you want both? You can switch account types during the promotion.

I wanted to go for the $500 bonus but misread the terms and thought opening smart advantage whil hitting $7500 spend would work

$7500 DD, you mean. You don’t need to open another account.

Prior to the 90 day or 120 day date,… Depending on the terms that you signed up for… You can change the account type to the better offer.

Current publicly available bonus is $500. My friend received a targeted offer for $600. Anyone asked for that higher one in-branch?

Generally speaking Banks don’t do matches on deposit account offers. But I’m assuming since you’re willing to ask the public, you have a crafty personality. Give them some charm and see what happens.

Any luck OOS? I’m outside the listed states and they let me open the account. I just want to make sure it won’t have an impact on my bonus eligibility.

It’s been nationwide for over a year… you are okay. Pepsi man

Pepsi man

I was gonna ask the same thing. I actually got a targeted email about this bonus but in not in the listed states either.

DP – Bonus-earning and account-closing data points:

– 11/1/2023 – Account (Relationship Checking) opened online

– 11/14/2023 – $7,510 transferred in from Schwab (Brokerage)

– 11/22/2023 – $2,540 transferred in from E*Trade

– Failed – $600 bonus NOT deposited into account

– 7/1/2024 – Balance transferred out

– 7/5/2024 – Account closed (via phone).

That’s a reverse bonus. You held 10k in your account and lost about 350 in potential interest

Yup. Sometimes, you lose. It helps (me, at least) to look at these bonus-earning activities as a portfolio or body of work.

where exactly are we supposed to be getting interest from terry

The investment or savings vehicle of your choice. Basically OP paid BMO for the failed opportunity.

My previous BMO Checking account was closed on 6/5/23. I applied today 7/8/24 for the Smart Advantage account but got a message that they couldn’t open an account for me because “we weren’t able to confirm your identity online”. They have an online page that lists the possible reasons for declining a new account (Poor Credit, Locked Credit files, Poor Chex report, wrong info, etc). My credit score is excellent, my Experian file was locked but TransUnion and Equifax were unlocked, my Chex report shows 17 new accounts in last 24 months :D. After unlocking my Experian file, I found out I could still log into BMO with my old ID/password (no active account shown) so I re-applied as an existing customer and was approved.

Am I correct in interpreting that if you want the $500 bonus, AND to avoid the $25/month fee, you need to have $10k (average DAILY balance) maintained? But you get 2 months “fee free” in order to lock up $10k in the account for 2 or 3 months? (ie, you need $10k in there on say, day 31 or 1st day of 2nd Calendar month and then need to keep that in there for the cumulative 90 days?) So basically you need 10k in there for a little over 2 calendar months?

Per their PDF:

Beginning in the third calendar month after your Account is opened or your Account type is changed to a

BMO Relationship Checking Account, we charge this fee on the last day of the statement period if you do not meet

ANY ONE of the waiver requirements listed below:

A.The minimum daily Ledger Balance in this Account is $10,000 or more for the previous calendar month.