Update 6/7/18: They now allow up to $100,000 at the 2.05% rate.

Offer at a glance

- Maximum bonus amount: 2.05% APY

- Availability: CT, DE, FL, ME, MD, MA, NH, RI, VT

- Additional requirements: $1,200 direct deposit, e-statements, 10 debit transactions

- Hard/soft pull: Soft

- ChexSystems: Yes

- Credit card funding: Unknown

- Monthly fees: None

- Insured: FDIC

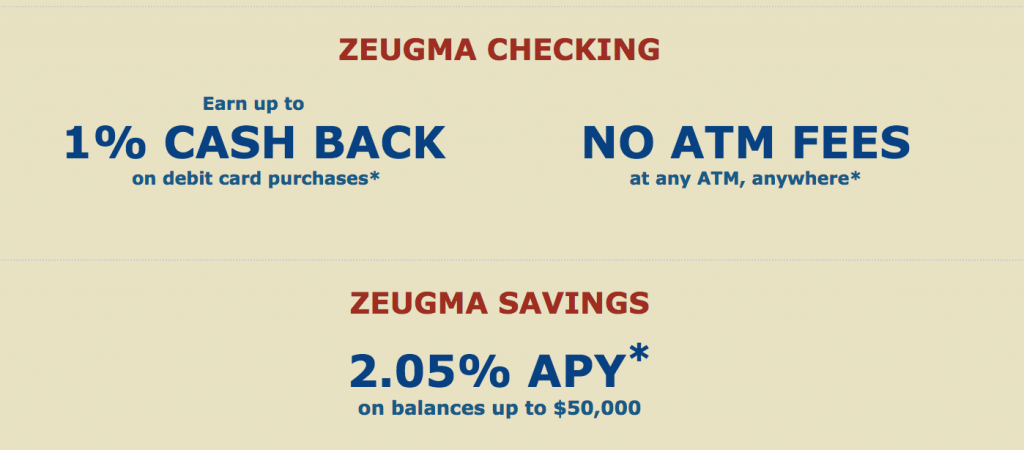

The Offer

- Leader Bank offers a 2.05% APY interest rate on balances up to

$50,000$100,000 with their Zeugma Rewards savings account

To be eligible for the 2.05% rate on their savings account, you’ll have to open a checking account as well and meet the following qualifications:

- $1,200 in direct deposits monthly

- Ten debit transactions monthly (the following count: checks, electronic payments, debit card transactions, and ATM transactions)

- Enroll in e-statements

Other Benefits

Aside from the 2.05% APY on the savings account, there are also a few benefits to the checking account, including:

- No ATM fees anywhere.

- Their debit card gives 1% back on all credit purchases. This isn’t too useful since most of us have a credit card that earns 2%, but if you have some merchant who only accepts debit that could be an added benefit.

- Get 10% off at select local retailers in Massachusetts.

The Fine Print

- Eligible Zeugma Checking accounts will be reimbursed up to $15 per month in ATM surcharges assessed by other banks and will receive debit card cash rewards of 1% on “Qualifying Purchases” per month. “Qualifying Purchases” include signature purchase transactions only where the customer selects “credit” as the transaction type.

- The debit card cash back rewards and ATM surcharge refunds will be paid by the 15th day of the following month for the accounts that qualify in the current statement cycle.

- $10 minimum balance to open Zeugma Checking and $10 minimum balance to open Zeugma Savings and earn APY.

- No minimum balance required to be eligible.

- When you are eligible for Zeugma Checking benefits, then the interest paid on Zeugma Savings in the next statement cycle on balances of $50,000 or less is 2.03% with an annual percentage yield (APY) of 2.05%; an interest rate of 0.20% APY will be paid only for that portion of your daily balance that is greater than $50,000.

- If you do not qualify for the Zeugma Checking, you will be paid 0.10% annual percentage yield (APY) on your entire balance in the Zeugma Savings.

- Annual Percentage Yield (APY) effective as of 7/1/16. Rate may change after account opening.

- Bonuses and gifts are subject to IRS tax reporting requirements IRS 1099-INT.

- Checking accounts subject to an inactivity fee of $10.00 for each 90 day period in which there is no customer initiated activity.

- One account per household.

- Not eligible with Step Anywhere relationship.

Our Verdict

If you do keep a full $50,000 in cash, you’ll earn around $1,000 per year in interest with this account, which is $500 more than a standard 1% APY savings account. An account like this will only make sense if you keep a nice amount of cash reserves since at smaller amounts you’d do better with something like the Insight card.

When looking into opening a new high-interest checking or savings account, I like to look at the overall Profit per Account. This account scores quite nicely on that scale. And it’s been around for at least two years so hopefully it’s here to stay.

We’ll add this our list of High Interest Savings Accounts.

Keep in mind that Leader Bank have stated that they run regular account reviews and if they think abuse is occurring they will downgrade accounts.

Hat tip to @pointsforlater via personal message

Letter from 10/6

on 11/7 – When qualified, the savings account will earn 2.05% APY up to 500k

on 12/1 – Minimum monthly deposit to qualify for 1% cash back/2.05% APY/ATM rebate will increase to $1.8k/month

I put this account on the backburner after Citi payments stopped earning 1%, but that deposit change is tilting me towards abusing it until a unicorn pops up or I get shut down.

Nevermind, this account has much more uses than I previously thought.

Lessons for all: keep good notes and retry things after awhile – surprises abound.

Can you please share which “much more uses” do you mean. I am thinking to close mine unless there is a good use of it.

Fintechs that allow for investments or have a debit card attached that you can load with debit. I retryed a few to my surprise they payed out.

Ok, thank you, I will have to research that. If you feel like dropping a hint, you can post a link to a DoC post that may shed some light – assuming this is allowed.

Available in CT, MA, NH, RI only

Received a letter stating after 8/31/2020 the rate will be 1.1% APY up to $250k with the same conditions – eStatements, $1200 DD/month, 10 debits monthly.

According to letter on 1/21/21:

On 2/22/21 the rate will be decreasing to 0.70% APY on up to $250k

Same requirements as above.

Where to buy usa gold coin for spot value of the gold in the coin?

WHere can a person buy a gold coin for the spot value of the gold in it ?

Effective 9/17/19 the new rate will be 2.13 with an APY of 2.15 for balances up to 250K.

Just got the following e-mail from Leader Bank:

New Year, new rate – we are excited to announce that we will be increasing the Zeugma qualified savings rate to 2.35% APY* (previously 2.05% APY) to be paid on balances up to $250,000 starting January 2, 2019! This new rate will automatically be applied to your balance in January, so get ready for even more savings.

Your link is broke, it’s no on https://www.leaderbank.com/personal-checking.html

Hi Chuck,

Just wanted to let you know that I tried applying for the Zeugma account, but FL is no longer available. I believe that Jay “Jay” posted a similar post on 08/11/2017. Please remove from the title as it doesn’t seem to work any longer. Thanks in advance,

Jay “Jay” posted a similar post on 08/11/2017. Please remove from the title as it doesn’t seem to work any longer. Thanks in advance,

Jorge

Be cautious with their ACH push limits!