Update: The fine print of the offer has some interesting language. See this post for a discussion about it.

The Offer

Direct Link business version / Direct Link personal Plus / Direct Link personal Premier

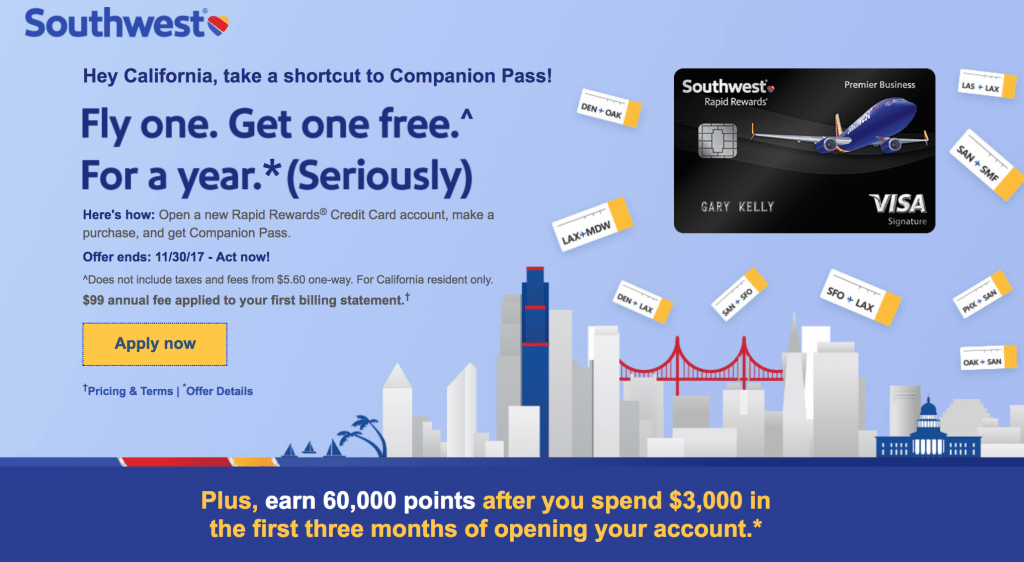

California residents get a shortcut to the Southwest Companion Pass:

- Open a new Rapid Rewards business Premier Card, make a purchase, and receive a Companion Pass. You’ll also earn 60,000 points after you spend $3,000 in the first three months of card opening.

- Open a new Rapid Rewards personal Plus Card, make a purchase, and receive a Companion Pass. You’ll also earn 40,000 points after you spend $1,000 in the first three months of card opening.

- Open a new Rapid Rewards personal Premier Card, make a purchase, and receive a Companion Pass. You’ll also earn 40,000 points after you spend $1,000 in the first three months of card opening.

Offers end November 30,2017.

Card Details

- Annual fee of $69/$99 is not waived first year

- Anniversary bonus of 3,000 points or Plus card, 6,000 points on Premier cards

- Chase 5/24 rule applies to this card

- Promotional Companion Pass is valid from the time promotion qualifications are met, through December 31, 2018

Our Verdict

Previously this Companion Pass deal was sent out as a targeted offer on the Plus card. Now, it’s available as a public offer to all California residents, also the offer is now available on all three versions of the card. Importantly, while the two personal versions come with a 40,000 bonus, the business version comes with the 60,000 bonus, a double-win.

There was recently a 60,000 offer on all three versions of the card available nationwide; only the 60k business offer is still available. California residents can now get the best bonus along with a free companion pass.

It’s important to note that this Companion Pass deal only works through 2018. If you’d go the regular route and earn the Pass with 110,000 in Southwest miles, you’d keep the Pass until the end of 2019 if you time yourself properly and have the miles post in January 2018. So this offer isn’t that incredible. Still a nice deal to get one year with one card signup, especially if you aren’t eligible for the personal cards due to the 24-month rule.

See this comment for an interesting way of maximizing this deal.

Hat tip to r/churning

Here’s a time sensitive question since the clock is ticking on this offer. My wife has a Southwest Premier Personal card that has been open since 2013. Can she cancel this card, wait a few days (so she’s no longer a current card member under the terms of this deal), then reapply for the 60,000 point business card? Assuming she’s approved, she could then make a single purchase in 2017 (qualifying for the pass). If she then waits to complete the $3,000 initial spend in early 2018 (netting 60,000 points in January) and re-applies for the Southwest Personal Premier (later that year) netting another 50,000 points and hopefully qualifying her for a companion pass into 2019. Any flaws in that plan?

OTTOMH, it sounds like a good plan.

Would it be possible to apply but not make a purchase until january in order to get CP for 2019 as well?

Actually, make a purchase late December and have the CP post in January?

Dp: got my CP today. applied on the day of this post.

So I got my credit card and made a purchase- now what? Any ideas on how to expedite getting the actual CP so I can start planning trips ASAP?

hm. not sure what to think of this. seems too generous. i wonder if this is some experiment given its only CA or some type of new rollout. obv many will be happy about this new CC bonus, but whenever I see overly generous offers, I take a step back. I guess people will just jump on this ASAP since a huge chunk are below 5/24. i feel like this is another CSR event led by chase.

Hawaii flights probably start in 2019…..

Thanks. This is a great explanation. Clears a lot of things 🙂

Does the business version of the card also count towards 5/24 ?

All SW cards do

Your question can be taken 2 different ways: 1) is the card subject to 5/24 rules or 2) will the business card increase your x/24 count:

The business card doesn’t count towards 5/24, but you have to be under 5/24 to apply. In other words, if you are 4/24 and you apply and are approved, you are not now 5/24, you’re still 4/24. However, if you’re 5/24 when you apply, you will get denied if you apply.

Hope that helps.

+1

I have a similar question.. I previously applied for both the personal and business SW cards back in 10/2015, and I now have the CP until 12/31/2017.

At that time, I used my SS# for my business card, as I was just a Sole Prop. I’ve since incorporated and now have a separate EIN#, so are you saying that this would count against my 5/24? I’m would think NO, as I would be using my EIN# under my actual Corporation name for the new business card via this offer (I’m in CA).

I already have CP till end of 2018. Will my CP be extended to end of 2019 if I do this?

Doubtful

Does the CA resident have to apply through the offer’s link, or can they use a referral?