Update 6/14/19: The 60,000 bonus on the personal cards is no longer available. Here are the best options for signing up currently.

Update 6/5/19: Reposting due to the upcoming end date of either June 26th or June 10th. Remember you can refer to any version of the Southwest card as well. More information on that here.

Mailers for this offer have been sent out with an end date of June 26th, 2019. Unclear if the online offer will end on 6/10 or 6/26, but this usually indicates it will be extended. Hat tip to reader YAR

The Offer

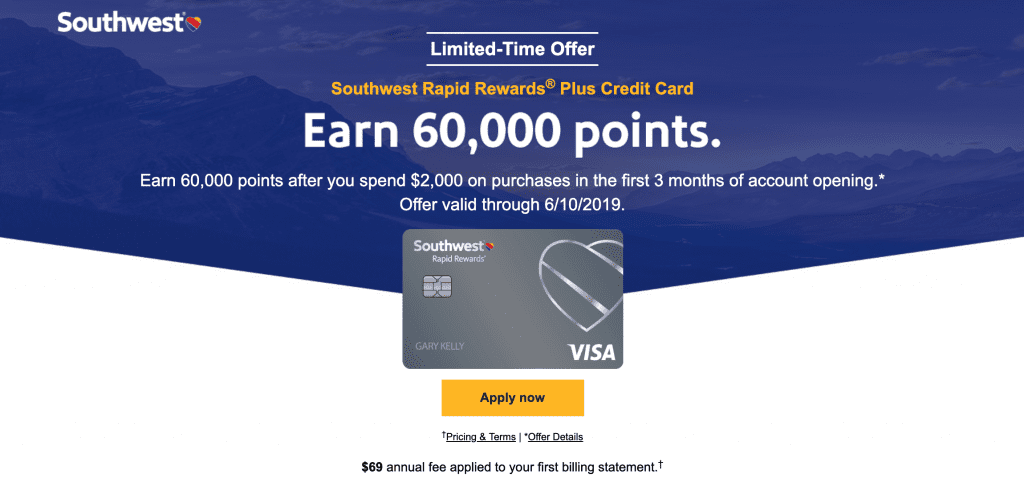

Chase has increased the signup bonus offer on all three versions of the Southwest personal card to a straightforward, non-tiered 60,000 points bonus with $2,000 in spend. The business version remains with its 60,000 bonus with $3,000 spend, as before.

- Southwest Plus personal card with $69 annual fee – 60,000 points bonus after $2,000 in spend within 3 months.

- Southwest Premier personal card with $99 annual fee – 60,000 points bonus after $2,000 in spend within 3 months.

- Southwest Priority personal card with $149 annual fee – 60,000 points bonus after $2,000 in spend within 3 months.

- Southwest Premier business card with $99 annual fee – 60,000 points bonus after $3,000 in spend within 3 months.

Note: there are some links still showing a lower 40k/$1k bonus, be sure to use these new (non-affiliate) links. These are time-limited offers.

Card Details

- Chase 5/24 rule does apply to this card

- Annual fees are not waived the first year

- The Premier personal and business cards earn a 6,000 points anniversary bonus; the Plus earns 3,000 points anniversary bonus; the Priority earns 7,500 anniversary bonus

- Chase Southwest Rapid Rewards Priority Credit Card Full Review & F.A.Q’s

- How Much Are Southwest Rapid Rewards Points Worth?

- Everything You Ever Wanted To Know About The Southwest Companion Pass

Our Verdict

The 50k or 60k offers come and go. The current offer until now was 40,000 points on $1,000 spend. We did recently see 60,000 points on all cards, but it required $12,000 in spend. The other option was to use the in-flight link for 50,000 points on $2,000 spend.

This new 60k/$2k offer is as good as it gets, and well worth signing up for if you are eligible in the 5/24 status. The important caveat here is that the timing of the deal is not ideal for the purposes of earning the Southwest Companion Pass; even if you’d meet the spend immediately, you’ll only land up with around 1.5 years with the Pass. Not bad, but not the greatest.

The easiest strategy to earn the Companion Pass has always been to get two Southwest credit card signup bonuses. You can only get one Southwest personal card; getting one personal and one business is the way to go.

Overall, it probably makes sense to go for these cards now if you use the Companion Pass moderately, but heavy Companion Pass users might want to forgo the highest bonus to optimize the timing instead.

Again, many of us are not eligible for any of the Southwest cards at all due to the 5/24 rule, or because you’re a current Southwest cardholder of any version or because you got a bonus within the past 24 months. Check out these Things to Know about Chase Credit Cards before applying.

Hat tip to Melbyts

Two questions on these cards if you don’t mind?

1) Is it possible to call chase to see how I look with the 5/24?

2) Can my wife get one of these and load my southwest number into it so I get the points?

Hey everyone – ONLY the person who’s name is on the app will get the points. IE, can’t combine Wife and Husband =)

Looks to be dead

I’m still seeing all of the 60k offers

Ah, yeah, I see now what you’re saying. Makes sense as it was showing a 6/10/19 end date. I don’t know of other links. Using the referral link if you’re in 2 player mode is now the best option, I guess.

Hey DoC, FYI I signed up using a friends referral link on 5/10 with the splash page showing 40k/$1k signup bonus. However when I asked to be matched to the current 60/$2k signup bonus, the rep said the referral bonus that was currently attached to my referral app was 50k/$1k, Might be a typo on the rep’s part but maybe some referrals are getting a signup bonus of 50k points for $1k spend.

I don’ have a travel companion(tear, lol). Is this still worth the sign up or should i save his chase slot for another card. Thanks.

Do you have to complete the MSR before the deal expires or just have the card by then to still receive the 60k?

I currently have these cards, so I can’t apply now. But if I cancel in the next couple of months, will I be able to apply for these around November or December? I can’t find any info saying whether or not Chase has a 12, 18, or 24 month period to wait after cancelling. (I’m well below 5/24)

I’d like to know this as well.

Chase 5/24 is like Brexit…….”we have made our decision” (even if it destroys us)

https://www.youtube.com/watch?v=SN0_yBDqjOA

I don’t have a business, any way to get 2 personal cards or any other option to get the companion pass without a business card sign up? Or can I apply for one and have wifey apply for another personal, would that work 🙂

I got 60k mailer. I’m at lol/24 and know that mailers don’t get people approved, but kinda want to do paper application to test that. Still debating if its worth the shot