Deal has ended, view more bank account bonuses by clicking here.

Update 6/7/21: Extended to September 30th

Update 5/22/21: Deal is back and valid until June 30, 2021.

Update 1/4/2021: Deal is back and valid until March 31, 2021.

Offer at a glance

- Maximum bonus amount: $200

- Availability: AL, AR, FL, GA, MD, MS, NC, SC, TN, WV, VA, and D.C Only

- Direct deposit required: No

- Additional requirements: Deposit $1,500

- Hard/soft pull: Soft

- ChexSystems: Mixed

- Credit card funding: Personal accounts can be funded up to $1,000, presumably business accounts are the same. Looks like the limit might be $500 for business.

- Monthly fees: Waived for first 12 months for simple business checking

- Early account termination fee:

- Expiration date:

April 30th, 2018 July 31st, 2018 October 15th, 2018 December 31st, 2018 April 1st, 2019July 1st, 2019December 31st, 2019March 31st, 2020June 30th, 2020 September 30th, 2020December 31, 2020June 30, 2021

Contents

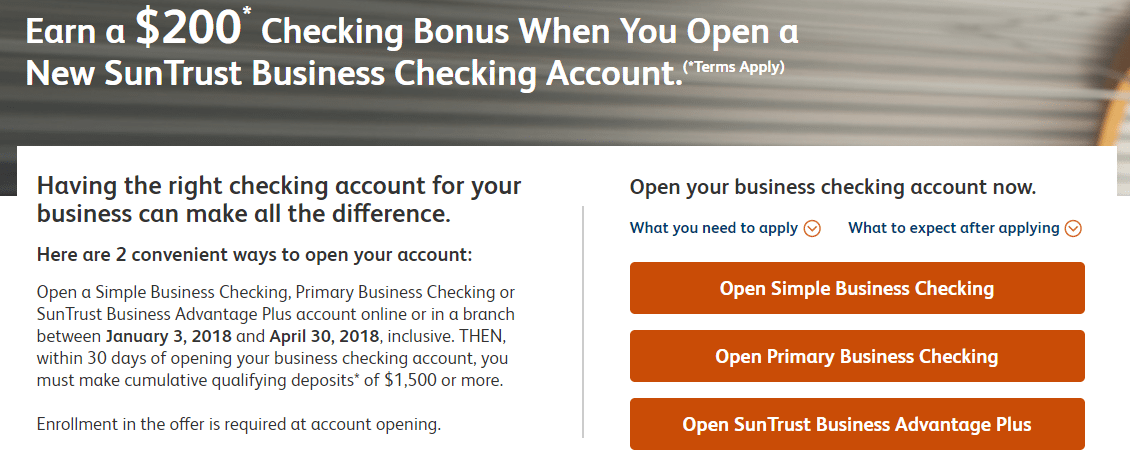

The Offer

- SunTrust is offering a bonus of $200 when you open a business checking account and complete the following requirements:

- Make cumulative qualifying deposits of $1,500 or more

The Fine Print

- You must be a new SunTrust business checking client. To be considered a new business checking client, the business cannot have an existing SunTrust business checking account with the with the same Taxpayer Identification Number (TIN), including but not limited to an Employer Identification Number (EIN), prior to promotion start. Existing business checking clients are not eligible for this offer. Public Fund and IOLTA accounts are not eligible for this promotion. The business client cannot have closed a business checking account within 180 days of the promotion start date (on or after July 7, 2017). The business account holder must be 18 years or older at time of account opening. The account holder cannot be a non-resident alien. Employee-designated accounts are not eligible for this promotion. The business must be registered within the U.S. with the account’s mailing address in Alabama, Arkansas, Georgia, Florida, Maryland, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, West Virginia or the District of Columbia and have a valid U.S. TIN or EIN.

- Earn $200. FIRST, open a Simple Business Checking, Primary Business Checking or SunTrust Business Advantage Plus account online or in a branch between January 3, 2018 and April 30, 2018, inclusive, and enroll in the offer by following the Branch Account Opening and Promotion Enrollment Instructions below. THEN, within 30 days of opening the new eligible business checking account, you must make cumulative qualifying deposits (as described in the Qualifying Deposits section below) of $1,500 or more into your new account.

- Qualifying deposits for new business checking accounts exclude debit card (credit) transactions and NSF fee refunds. Deposits can be made on a one-time basis or cumulatively over the 30 days.

- After meeting all qualification requirements, the cash reward will be deposited into the new eligible business checking account in up to 8 weeks after all qualifications are met. If the $1,500 new checking account deposit requirement is not met, you will not be eligible for the reward. When the cash reward is deposited, it will appear in your new business checking account monthly statement as “Q1 2018 Small Business Checking Reward.” This offer is only applicable once per client. SunTrust may report the value of any reward received through any offer to the Internal Revenue Service, as required by law. Any applicable taxes are the responsibility of the recipient.

- The new business checking account must remain open and in good standing with a minimum balance of $0.01 until the reward is processed in order to receive the reward. Reward forfeiture will occur if: (1) the business checking account is changed to an account type not included in this client offer, (2) the business checking account is closed prior to the reward being processed, or (3) the new business checking account has a negative available balance at the time of qualification validation. SunTrust reserves the right to deduct the reward amount from the business checking account at the time of closing if the new business checking account is closed by the client or SunTrust within 180 days after opening.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Simple Business Checking

This account has no monthly fee for the first 12 months. After that period you can waive it with 5 or more transactions.

Early Account Termination Fee

Account needs to be kept open for 180 days otherwise the bonus is forfeit.

Our Verdict

Last few months they have had a bonus that required merchant services. Last year they had a similar deal but bonus was up to $400. Advantage to this bonus is that there is no monthly maintenance fees to worry about. Bonus seems very easy to qualify for just open the simple business checking account and deposit $1,500. Even better is cumulative deposits count for those that don’t have $1,500. I think I’ll add this to the best business checking bonuses. There is also a a $500 personal checking bonus.

Big thanks to reader, Stammers95 who let us know. Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Post history:

- Update 10/11/20: Extended until December 31, 2020.

- Update 7/24/19: previously the terms stated:

- The business client cannot have closed a business checking account within 180 days of the promotion start date

- That has now been reduced to 90 days (The business client cannot have closed a business checking account within 90 days of the promotion start date (on or after 04/03/2019). Might be last chance to get it from SunTrust before they merge BB&T

- Extended until September 30th, 2019.

Anybody received 1099-INT for this? I closed my account already and could not log in into Truist. I didn’t receive tax forms for this in the mail or via e-mail either.

My 200 posted. Opening CC deposit counted. Online banking was difficult to set up so I’ve instead been checking my balance by phone.

How are you avoiding the paperless fee without being able to access business online?

Good point. I was planning on eating the fee. So far though I haven’t been charged anything, and hoping it falls under their waived fees for the first 12 months.

Can we pull the 1500 + 200 out once the bonus posts? Doesn’t seem to be any minimum requirement. Safe to just pull the money out and close after a year?

That’s what I did. Just left $100 in.

Next batch should be paid out soon. Went to reward pending.

This current batch bonuses posted today.

Link shows promotion ending on 6/30.

Online application got denied as a sole prop with SSN. Previous joint personal checking holder that closed over a year ago.

Set up business account with $1,500 deposit on 5/25

$200.00 bonus showed up 6/24

P1 online funding online posted as purchase w/ elan fidelity.

p2 online funding w/ boa prem rewards and a lowered CA limit failed.

For P2, Decided to experiment in branch by funding using elan fidelity. That came over as cash advance.

Online MCC: FINANCIAL INSTITUTION-MERCHANDISE AND SERVICES

In-branch MCC: FI-MANUAL CASH DiSBURSEMENTS

How much you fund?

1k

Be warned regardless if you’re approved online or not, local branch interaction is required whether it be signing physical documents or getting them to get you business online access. Finally got online access after two weeks. It seems their business banking side isn’t automated and requires lots of manual work behind the scenes.

I had the exact same experience. Took 2 weeks+ to finally set up online access, and this was only after meeting with them in branch. It’s a lot of hoops to jump through for $200, but I was able to deposit the $1500 at that visit, and now I just have to wait for the bonus.

Online application always results in “This service is not available at this time.” and requires me to go in branch.

The business banker tells me I need a business license in TN.

Skipping this because it seems like more hassle than it’s worth as my first-time business account.

will BB&T have something to offer for those outside of Suntrust’s footprint?

I’m outside the SunTrust footprint and I got a $200 checking account bonus from BB&T about a year or so ago.