This bonus has expired, view more HomeStreet bank bonuses here or the best checking bonuses here.

Offer at a glance

- Maximum bonus amount:

- Availability: Branches are in WA, CA, OR, ID, HI. Available online or in-branch; probably only available online to those within the bank’s footprint.

- Direct deposit required: Yes, $1,000+

- Additional requirements: None

- Hard/soft pull: Soft

- ChexSystems: Unknown

- Credit card funding: None

- Monthly fees: $10, waivable

- Early account termination fee: $15 if closed within 90 days

- Household limit: One per mailing address

- Expiration date: August 15th, 2018

The Offer

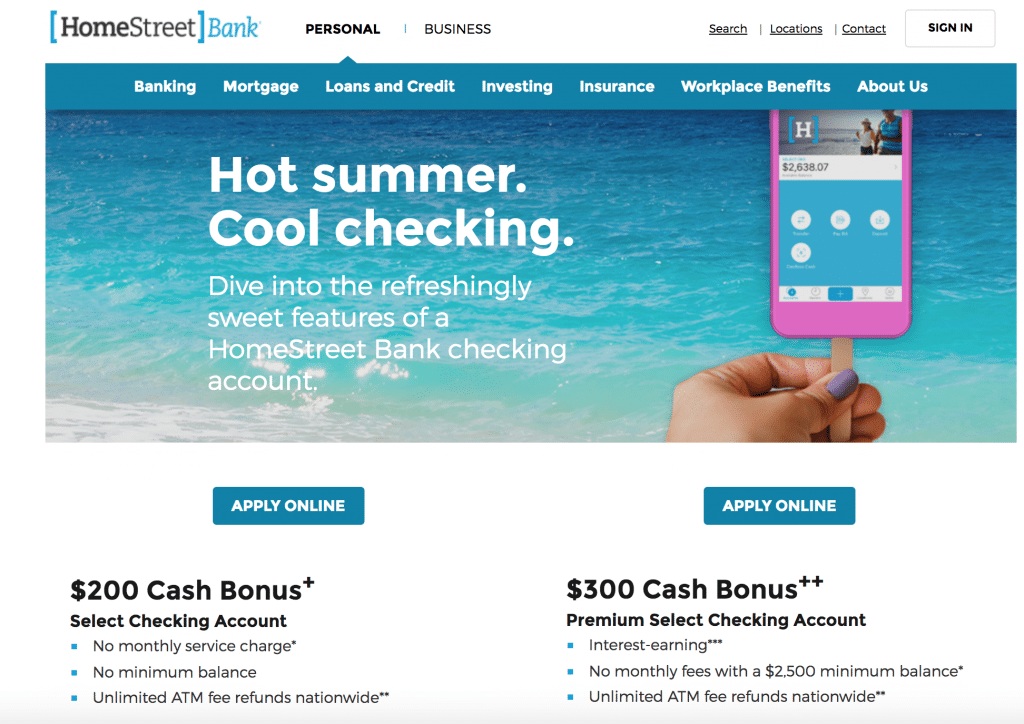

- HomeStreet Bank is offering a bonus of $300 when you open the Premium Select checking account and receive a direct deposit of $1,000 within 60 days.

- HomeStreet Bank is offering a bonus of $200 when you open the Select Checking account and receive a direct deposit of $1,000 within 60 days.

The Fine Print

- Valid online or in branch between 08/09/2018 and 08/15/2018.

- Minimum opening deposit of $100.

- Receive qualifying direct deposits of $1,000.00 or more within the first 60 calendar days of account opening. A qualifying direct deposit is an electronic deposit from your employer, pension, or government benefits (such as social security). However, federal income tax refunds, or any state income tax refunds, are not considered qualifying direct deposits. Person-to-Person and bank transfers between your HomeStreet Bank accounts or accounts you have at other financial institutions or brokerages also do not qualify.

- Bonus will be paid within 100 calendar days of account opening if the bonus requirements are met.

- Your new account must remain open until the bonus is processed in order to receive the bonus.

- The bonus is considered interest and will be reported on IRS Form 1099-INT.

- This offer is only available to new HomeStreet Bank consumer checking account customers. This offer is not available to existing HomeStreet Bank consumer checking customers (either as the primary or secondary account holder) or individuals who have had a HomeStreet Bank consumer checking account in the last 12 months. Bank employees and members of their household are not eligible for this promotion.

- Limit of one new consumer checking account bonus per individual and per mailing address. If the customer or other individuals residing at the same address received or may receive any other consumer checking bonus from HomeStreet Bank within the last 12 months prior to this account opening then no one at the address is eligible.

- The new account is available only to individuals and is not available to businesses, non-profits, or for use as a personal retirement account.

- HomeStreet Bank reserves the right to deduct the bonus from the account at closing if the account is closed by the customer or bank within 180 calendar days after account opening.

Avoiding Fees

- Premium Checking comes with a $10 monthly fee; maintain a $2,500 balance to avoid monthly fee. Select checking does not come with any monthly fees.

- There is an early account termination fee of $15 if the account is closed within 90 days of account opening.

- You need to keep the account open for 180 days to avoid having the bonus clawed back.

Our Verdict

L0oks like a pretty sweet bonus and much easier than prior bonuses. Just meet the direct deposit requirement and you’ll get $300. You do need to park $2,500 there for 180 days to avoid the monthly fee, or else swallow the monthly fee or do the $200 bonus.

Readers note that they are Chex sensitive and will close the account if they don’t like your Chex. Only worth doing if yours has light activity.

Big thanks to many readers who let us know about this (AJ, DP, Nate, KL, MQ). Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

closing this account appears to be difficult. i called the 800 number and they said they can’t close it over the phone. I have to either mail in the request or go to the local branch. I asked if there’s other method, since no branch near me at all, after the customer service person asked around and came back saying i can email in a scanned copy of the request to close it too.

i asked if i want a casher’s check to be mailed to me, if there’s a charge for that? he said he’s not sure, usually there’s a 5 dollars charge, but since i m closing the account, might waive that. but he is not sure.

i guess i have to scan in the request and go from there. will report back once it’s done.

WARNING: I DID NOT GET THE BONUS AND LOST $20 ON THIS DEAL! Pretty frustrated here. Applied for account on 08/12, approved and $100 deposit processed 08/27. Spent the next 30 days funding my account via various ACH’s from other banks and various gig economy jobs (Lyft & Amazon). By 09/26 my account had over $2,500 in it, and on 09/28 I ACH’ed out the excess to leave the account with $2,500 exactly. On 10/05 I got hit with a $10 service charge and used secure messaging to ask them to remove it as it was an error. They explained it was because my account was under $2,500. I explained that it was the first month of my account and I was funding the account and to please just reverse the charge. They said I’d have to call in to do that, which I did and I told the charge would be reversed. I realiazed that the first $10 service charge would cause my account to go below $2,500 for October, so I would obviously get another $10 service charge on 11/05. On 10/15 when I realized this I ACH’ed in $50 so it wouldn’t be a continous cycle. Sure enough, on 11/05, another $10 service fee hit. Further, the original $10 fee reversal never hit. I was dreading another phone call to try to resolve this so I figured I’d just wait for the $300 bonus to hit and decide then if I wanted to call again to get the $20 back or just call it a $280 win. The $300 never posted. Now it’s 01/16 and I finally set aside some time to call in. First they claimed I didn’t use the debit card per the terms, and when I informed her that was not the promotion I signed up for, she looked through it again and came back with the information that my direct deposits weren’t QUALIFYING direct deposits since they didn’t come from a payroll company. DoC has successful ACH data points but they are from 2016, so either something changed or HomeStreet is just making things up at this point. The supervisor I spoke with agreed to give me a COURTESY $10 credit for ONE of the service charges but even refused to give me the other credit. That’s pretty ridiculous as my deposit history makes it very clear I should not have been charged the first service fee, which caused the second service fee. The supervisor also said I won’t be getting the bonus. It’s really disheartening when a bank posts a promotion and I meet all of the terms on the promotion only to have them make up rules after the fact. I’ve encountered this sort of thing once or twice before with other banks, and I’ve had a 50/50 success ratio on banks honoring the promotion as it’s clear I filfilled the requirement in good faith. I plan to run this up the chain, but at this point it doesn’t look like… Read more »

Well, it looks like HomeStreet Bank _IS_ doing the right thing.

Just got a call back from a supervisor. They reviewed my account and discussed with a manager and made a “one time exception” to honor the bonus and reverse the service fees. Hopefully they show up in my account in the few days as promised and this will be the end of this saga.

But the takeaway seems clear on this, so hopefully William Charles can update the data points… *** ACH looks to NOT trigger the direct deposit requirement for HomeStreet Bank in 2018 ***

William Charles can update the data points… *** ACH looks to NOT trigger the direct deposit requirement for HomeStreet Bank in 2018 ***

What ACH did you actually use?

Sorry for the late response, never saw your message William Charles. I had ACH’s from Lyft and Amazon Flex.

William Charles. I had ACH’s from Lyft and Amazon Flex.

Np, thanks

Sweet, $300 bonus posted on 10/31. Will wait till Feb to close to the account 😉

My bonus processed 10/31. DD was from p2’s work in two ~$600 portions.

did you use legit work DD or bank transfers? If bank transfers which did you use? thanks!

Select checking account opened 8/20. DD from employer posted 9/14. $200 bonus posted 10/31.

I sent a message to customer service on 10/29 asking when to expect the bonus and received a canned response back without any specific date (“Bonus will be paid within 100 Calendar days of account opening if the bonus requirements are met. Your new account must remain open until the bonus is processed in order to receive the bonus.”). I’m not sure if that helped nudge the bonus posting.

DD from my employer hit 10/12. $300 bonus posted on 10/23. Not bad, now just need to wait for 6 months with the $2500 there.

Wow. My DD hit on 9/7 and still no bonus. When I messaged them, they stated they hadn’t reviewed accounts yet associated with the offer. You’re making me wonder if I’m in the minority now with not receiving it yet.

DD hit on 9/14 and so far no bonus yet. Looks like we are on the same boat

DP: $10 bank fee was not waived despite calling.

9/6: $100 initial deposit

9/14: employer DD $1k (9/28: Bill pay -$1k)

9/28: employer DD $1k (10/3: Bill pay -$1k)

10/5: $10 service fee hit

Since the minimum balance requires to keep fee free was $2.5k, I didn’t meet the requirement before the statement hit and was charged a fee.

I was going to do the usual song and dance to get the fee waived but the CSR was adamant that he cannot waive a service fee. I complained that despite the billpay, I could not have met the minimum balance within 30 days given the DD schedule… No luck.

For anyone who has done DD with Homestreet recently, what worked?

I’ve done 1 payroll DD (more than $1,000) so far. By the way, is 1 $1000 DD enough to fulfill the DD requirement?

I Secure Messaged HomeStreet Bank to verify whether or not a single direct deposit of $1,000.00 or more was sufficient to meet the DD requirement. Was told (through SM) to call their toll free customer service 800-719-8080. I called and phone rep confirmed that my single payroll direct deposit of more than $1,000 has fulfilled the DD requirement since it was from employer and was deposited within 60 days.

Thanks for DP

Two weeks later and account is still open. They’re still holding my $100 opening deposit, but I’m guessing that’s maybe until they receive and process my paperwork.

I was 19/24 and 10/12 when I applied.

When it says “qualifying direct deposits of $1,000.00 or more”, does that mean 2 or more direct deposits are needed within 30 days or will 1 direct deposit of more than $1,000 be sufficient?

Opened Premium Checking last week. Sent check and check is pending deposit as of today. I had opened 13 bank accounts since 10/2017 and my account has not been shut down so there’s hope regarding the Chex sensitivity.