This bonus has expired and is no longer valid. Click here to view the best current checking bonuses.

Offer at a glance

- Maximum bonus amount: $250

- Availability: AZ, CT, DC, DE, MD, NJ, NY, PA, VA, WV

- Direct deposit required: Yes, $100

- Additional requirements: Open MyChoice account

- Hard/soft pull: Soft

- ChexSystems: Yes

- Credit card funding: None

- Monthly fees: Avoidable

- Early account termination fee: $50 180-days

- Expiration date: May 31st, 2017

- Household limit: None listed

Contents

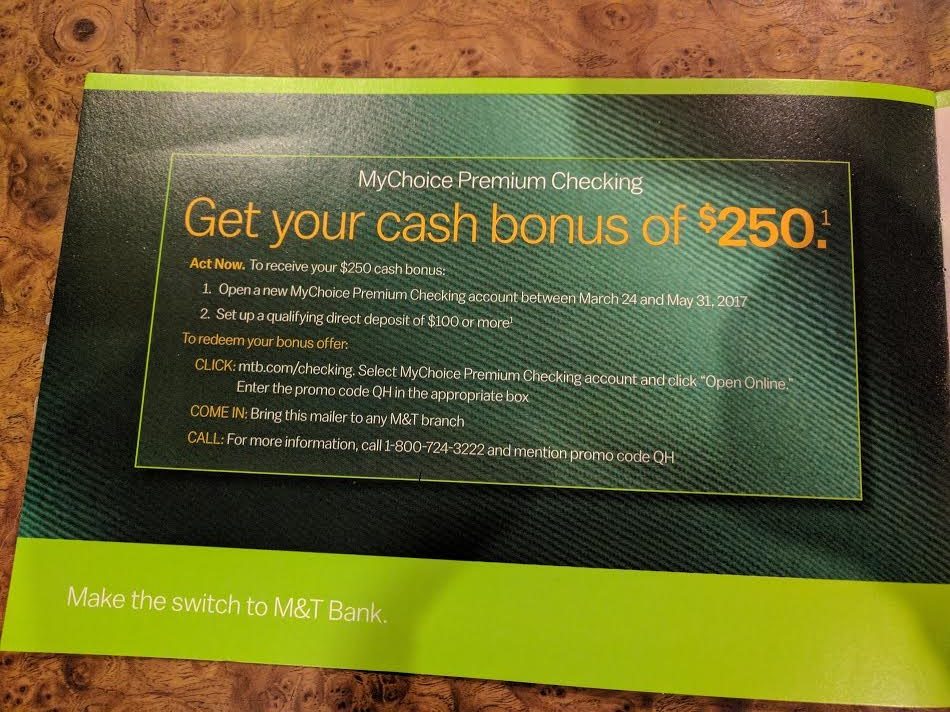

The Offer

No direct link to offer (go to mtb.com/checking and enter promo code QH, supposed to be targeted but hasn’t been enforced in the past)

- Open a new M&T MyChoice Premium checking account by May 31st, 2017 with the promotional code QH and receive a sign up bonus of $250 when you do the following:

- Set up a qualifying direct deposit of $100 or more within 90 days of account opening

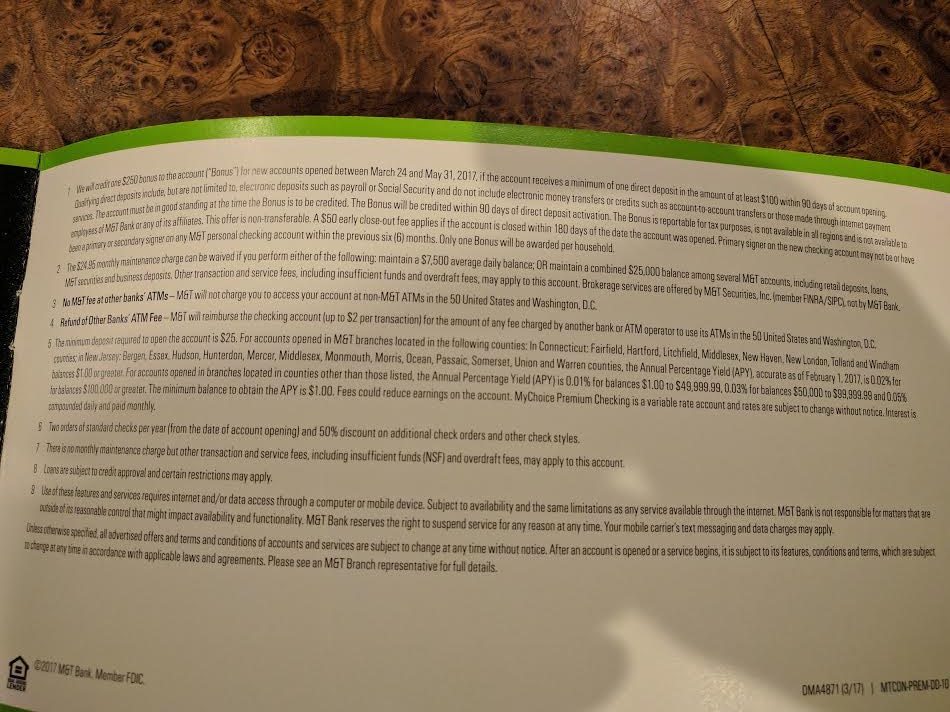

The Fine Print

- Primary signer on the new checking account may not be or have been a primary or secondary signer on any M&T personal checking account within the previous six (6) months. Only one bonus awarded per household

- Qualifying direct deposits include but are not limited to electronic deposits such as payroll or social security and do not include electronic money transfers or credits such as account-to-account transfers or those made through internet payment services

- Bonus will post to the account within 90 days of meeting the direct deposit requirement

- Limited to one bonus per customer

- Offer may vary by region and product

- Offer is nontransferable

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Unlike other M&T bank promotions, this one only works on the MyChoice Premium checking account. First month fee is waived according to this comment.

MyChoice Premium Checking $24.95 Per Month

This account has a $24.95 per month fee, this is waived when you do either of the following:

- Keep an average daily balance of $7,500 or more in the account per monthly service charge cycle OR

- Keep total combined balances of $25,000 or more in eligible personal deposit accounts, loans and home equity outstanding balances, investments6 and business deposit accounts

Early Account Termination Fee

Looks to be $50 now if closed within 180 days

Our Verdict

These bonuses from M&T keep stacking up (because you can seemingly churn them with no restrictions, one bonus per promo code). The deal is technically targeted, but not enforced. In addition neither is the state restriction…

They also have the following offers:

- M&T Bank $150 Checking Bonus – Available Online (QC) [AZ, CT, DC, DE, MD, NJ, NY, PA, VA, WV]

- M&T Bank $150 Checking Bonus – Available Online (QD) [AZ, CT, DC, DE, MD, NJ, NY, PA, VA, WV]

- M&T Bank $200 Checking Bonus (QI) – Available Online [CT, DC, DE, MD, NJ, NY, PA, VA, WV]

I really hope this continues. Also adding this to our list of the best bank account bonuses.

Big thanks to reader, Richard B who let us know. Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

Can anyone tell me how to activate internal M&T account transfers? I tried tonight but it only gives me a prompt to request a debit card, and well, I have 6. Where do you go to input the info it wants to open the transfer feature?

There’s nothing to activate really. Mouse over the tab Payments and Transfers. A menu appears then click on Transfer between your M&T accounts.

The rest is just clicking on drop down boxes and entering a $ amount. No need to enter account numbers at all. All of your options are there.

I thought it would be intuitive but maybe I am getting some other screen first? Here is what it looks like for me. The request a new card link takes me to a page that is not available and there are not other clickable links. Definitely do not want to call in. I cant add a screen shot but here is the text.

Activate Transfers and Payments

You are currently not authorized for Transfers and Payments.

Transfers and Loan Payments is available to all account holders.

In order to activate Transfers and Payments, we need some additional information. We require this for added security and you will only need to do it one time.

Request a Card

To protect your information, we ask all customers to activate Transfers and Payments by entering their M&T Check Card or ATM Card and the associated PIN or their M&T Credit Card and the associated 3-Digit Security Code. To request a card, click the button below or call M&T Online Customer Service at 1-800-790-9130 (Mon-Fri 8am-9pm, Sat-Sun 9am-5pm ET).

I had this happen to me too and I picked a debit card at random from my stack and that worked to enable transfers. Could have been the one they wanted but I had 4 or 5 accounts at the time so odds are it wasn’t.

I’m not even receiving a place to input a card number or try to verify myself. Was there a link you clicked to do your input?

Yes. But this was months ago so I don’t remember well. Maybe try on another browser?

I can’t reply to Josh’s comment, but I’m having the same issue… no place to input a card number. I really want to avoid calling in and having eyes on my account but I can’t figure this out.

The problem resolved itself for me yesterday. Not sure if it was an M&T issue but here is one possible cause. My 6th account was in process of opening. I still have not received the card yet. Maybe it assumed I needed to request a card for that account? Either way, 5 of my 6 accounts now show on the transfer screen. Dont know if cards needed to be activated but I did that on Saturday for all.

For those wondering, this code DID expire. I opened an account on 6/4/2017 and ACH’d $100 as usual. No bonus has posted, when it is usually instant. Oh well, there will be more.

Thanks, Moose.

Just received $250 bonus: opened acct on 5/24/17, transferred $7,500 from Vanguard (it posted on 6/5/17; shows as “VGI-PRIME MM INVESTMENT”), $250 bonus posted same day (6/5/17).

The requirement for the bonus was only $100 deposit, the $7,500 is required to waive the monthly fee. Or you can downgrade your account after 2 weeks.

Has anyone been successful using this code after the expiration date?

+1

So I posted my p2p on 5/31 and I still have not gotten my bonus any thoughts ?

What’s your external bank, and did you initiate the ACH from the external account? Normally M&T pays out the bonus for any ACH at all, nothing has not worked.

So this is my second MT account ally bank was what I used for this account and the first one one as well, with the first account bonus was posted as soon as put in the direct deposit.

I wonder if I screwed up somewhere in the process.

How much did you transfer for both times? What code did you use for both and when did you open both accounts?

I transferred 150 for both accounts, first account was the QI bonus on may 16. Second account was QH opened on May 24 its a my choice premium so I need to downgrade soon.

That’s odd, I don’t know why it didn’t post. Maybe someone else can help, but I would not talk to the bank about this.

I just opened 2 QH and one of them has $101 Ally ACH hitting today. Expecting bonus to show tomorrow. Will confirm.

Thanks will see appericate it.

Did you apply for 2 MyChoice Premium accounts with QH on or before May 31,2017?!:)

@Ian, yea both were before that date. Seems to take ~6 days from application to linked online. Already received both bonuses and transferred out of M&T. Spouse and self…

@Brian

It’s not you fault. It happened with me also and there is nothing you can do about it without attracting unnecessary attention from M&T.

I just moved on to next promotion and suggest the same for you.

ya there is a few more to do so not a big deal its not worth poking the M & T piggy bank

Can’t reply to last post on mobile… But bonus hit with deposit as expected with all other M&T scores. Transfering out now. Maybe you missed input of the promo code? Just a guess but I agree with the logic to move on to the next. These are so incredibly easy – love it.

will see used a different code fun moment though when I made the new account it had the promo code for the 250 saved so I am pretty sure I put the right one in

Opened the $200 offer before expiration, then opened this one $250 offer before expiration.

Bonuses posted as soon as ACH push hit, but the bonuses won’t show until next day morning.

ACCOUNT#1 (all those are business days)

DAY1: opened the account with offer code, got account number, setup online access before business hours (10PM EST);

DAY2: did $100 Santander push;

DAY3: debit from funding source account, ACH push posted, bonus posted though not showing

DAY4: bonus shown up with DAY3 date;

DAY5: $25 initial account funding posted.

Several days later repeat same progress, except I waited 1 extra day to do push to make sure everything is working because second account was not added to online account instantly.

ACCOUNT#2 (this $250 offer)

DAY1: opened the account with offer code, yes and provided ACCOUNT#1 number, got second account number, but account was not added to online account as expected;

DAY2: nothing, just waited it out;

DAY3: debit from funding source account, seeing the debit was working, made $100 Santander push

DAY4: ACH push posted, bonus posted but not showing;

DAY5: Bonus shown up with DAY4 date, $25 funding not showing cuz it was weekend.

Few days later received debit card and activated, called the number on the back to get account balance due to no online access, found out DAY4 and DAY5 info, next day after card activation second account was added to online account. Everything was so smooth except I haven’t faxed in signature card for my second account yet, each account took around 1 week to finish.

I opened my second account yesterday. I received the account number and I clicked ‘Enroll Now’ at the bottom of the application in hopes that it would prompt the account to show up on my online banking.. it did not.

How long does it take for the account to show up?

Did you enter an existing account in the application? If not it takes more time to link them. Check in the evening and in the morning, as that’s the best time I’ve found that they add accounts online.

Ken,

Thanks for the reply. I did include my existing account number. Hopefully it shows up this evening or tomorrow!

I replied to your comment at end indirectly due to replying issue. Just wanted to send you email notice if your following

Don’t know if you guys knew about this, but an easy way to access the Account number is to just sign on from the app.

I called in to ask last week and the tech guy suggested it because it’s a new feature on the app.

I transferred over $100 from my Chase checking. For some reason it automatically transferred back.

I’ve tried this twice with the same results.

Any advice?

So I have opened up to MT bank accounts so far different codes first one showed up online I got the bonus then opened another one. On May 19 and it still has not shown up online. should I be worried? what funny is my initial deposit has been processed as well as my verification payments I just cant see it.

Give it a few more days and you will see it. Next time, click the enroll now button in the confirmation page. The new account will show up right away (provided u did get the ac# in the confirmation screen).

Thank you so much ya it appears from reading the comments that to get the account number to show you need to fund it with a different bank account to get the numbers to show.