The Offer

Direct link to offer (or help a reader and use a referral)

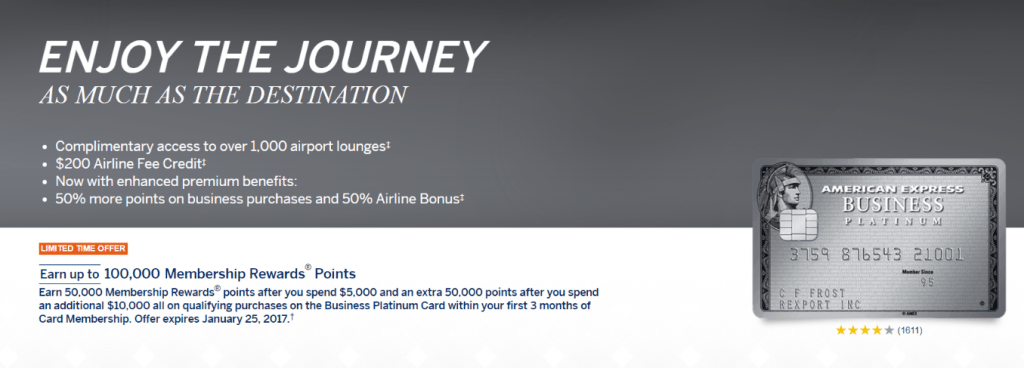

- Receive a sign up bonus of 100,000 points on the American Express Business Platinum card, bonus is broken down as follows:

- 50,000 points after $5,000 in spend within the first three months

- An additional 50,000 points after you spend an additional $10,000 within the first three months

Card Details

- Offer expires on January 25th, 2017

- Annual fee of $450 is not waived the first year

- Card earns at the following rates:

- 2x points per $1 spent on purchases made directly from the American Express travel website

- 1.5x points per $1 spent on qualifying purchases of $5,000 or more (up to 1 million extra points per year)

- 1x points on all other purchases

- 50% of points back when redeemed for first/business class tickets or any fare class with your selected airline

- $200 airline incidental credit per calendar year

- Lounge access:

- Centurion lounge access

- International American Express lounge access

- Delta SkyClub lounge access

- Priority pass select membership

- Airspace lounge access

- Internet Access:

- 10 free GoGo passes

- Unlimited Boingo internet access

- SPG gold status

- Fee Credit for Global Entry or TSA Pre✓

- No foreign transaction fees

- View these other hidden benefits

- You can only get the sign up bonus on American Express cards once per lifetime

Our Verdict

This is part of American Express trying to compete with the Chase Sapphire Reserve (as we rumored), this card now earns 1.5x points on single purchases over $5,000 (up to 1 million additional points per year) and comes with a 50% airline bonus as well – making points worth 2¢ per point as well. There are targeted bonuses of 150,000, but these are quite rare. It’s been possible to get 75,000 points with $5,000 spend recently (but YMMV) and last year we had a publicly available 150,000 point offer (that wasn’t supposed to be public) (that required $20,000 in spend).

[Read: Premium Cards Compared: Chase Sapphire Reserve, American Express Platinum & Citi Prestige]

Honestly, I’d be very careful with any manufactured spending on this card as I suspect American Express will ramp up their efforts to cut this practice out. Meeting $15,000 spend in three months will be out of reach for most people (especially since it’s an American Express card). Before applying for this card or asking common questions in the comments, I’d recommend reading this post on American Express cards. You may also be interested in learning about the hidden benefits of this card.

Personally I’m hoping that this isn’t all American Express have planned to compete with the Chase Sapphire Reserve. I think the reason that card is so popular is that it’s easy to under the value proposition and the spend requirement isn’t insane. American Express’ style of having to choose a specific airline isn’t consumer friendly and it’s much harder to explain easily why this is a good deal. Through a massive spend requirement on top of this and American Express misses the mark for most regular people but perhaps they are going back to their roots and trying to target the ultra wealthy and businesses that wouldn’t bat an eye at spending $5,000 per month on a credit card.

I am a regular Southwest flyer. Does anybody know if I can buy Southwest gift cards with the Business Platinum card on southwest.com and pay with points with the 50% rebate?

I don’t know, but want to see if anyone answers your question!

No. To get the 50% rebate you need to book a flight through the AMEX flight portal.

Can I pay my tax bill using pay1040.com and meet min spend? Any experiences with this?

It worked with amex gift card, so I don’t see why not.

I made a $3k estimated tax payment to meet the minimum spend on the 100k Platinum offer and have not been clawed back.

I’ll likely go for this, and likely MS most of the spend. I’ve always been a gambler, and I’d be willing to bet Amex won’t be individually checking each of these accounts. AKA, I think the leaked personal plat 100k was the majority of Amex’s crazy phase.

And either way–I’ll be the guinea pig!

Not as much is lost besides of time if the game doesn’t go thru. The odds are high it will be successful as clearly rules were breached during the infamous offer. It may have been foolish by the army of newbies and a few vets to hop on that bandwagon using a targeted link. I just caved in and went for an pre-approved Premium Gold with only 25k points and $100 in credit x 2 but only $1k spent. Approved even my last CC was opened not even a month ago. I will think for the rest of the day about this offer.

haha. OK boss. you go do that. report back after your CFPB.

Bamn got my points. No CFPB. So looks like ur missing out because of fear. You have nothing to fear but fear itself.

It’s a trap!

Boom got my points. So much for its a trap theory.

Never apply for Amex. I have blacklisted Amex! You will never get your points.

Sad for you. MRs are of extreme value for travel hackers. I keep a goodstash around. There is no expiration with the free everyday card. One could argue there is no better currency than MRs and only transfer to United lags.

When you do MS, you shouldnt get bonuses with any card!

After those nasty clawbacks I’m wary of any 100k Amex signup bonuses..

since this offer expires in Jan 25, 2017 —- if you apply in 10 Dec, 2016, and assuming you are auto-approve, can you then be able to use the “$200 airline incidental credit per calendar year” a total of 3x then cancel the card before the Year 2 annual fee comes up?

i heard you can do something like that with Citi Prestige, but not clear on the mechanics behind it. so not sure if the same can apply in this situation

THIS IS A TRAP!

I SEE WHAT YOU DID THERE AMEX…

“We will credit the 50,000 additional points or another 50,000 additional points (for a total of 100,000 points) depending on whether you spent $5,000 or more or $15,000 or more on qualifying purchases during those first 3 months. Offer may not be combined with any other special offer. If your application is not received by 1/25/2017, you will not be eligible for the up to 100,000 membership rewards points even if your application is approved. *Qualifying purchases do NOT include fees or interest charges, cash advances, purchases of traveler’s checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

Additional terms and restrictions apply.”

My cut and past doesn’t show that they bolded “qualifying” – and their verbiage is clear that any MS will not get the bonus. Amex is not going to get many takers for these sorts of offers…

Same wording as always so no changes there. Spending $15k in 3 months is too high if enforced. If not enforced, it is not as bad with 115k as a result.

My sister has been targeted for a similar offer but for 150K MR, same $15K spend. She has gotten the offer multiple times in the mail, but she doesn’t play this game.

but… you do…

Is this offer tranferrable? Isn’t it targeted?

Have her apply and make you an authorized user. You spend. You pay bill. 🙂