Deal has expired, view more bank account bonuses by clicking here.

Update 9/22/19: Reposting as it’s a soft pull to open.

Offer at a glance

- Maximum bonus amount: $500

- Availability: CA, IL, NJ, NY, TX, VA in branch only. [Branch locations]

- Direct deposit required: No

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown, not sensitive

- Credit card funding: Unknown

- Monthly fees: $6-$7

- Early account termination fee: Six months, bonus forfeit

- Household limit: None listed

- Expiration date: None listed

Contents

The Offer

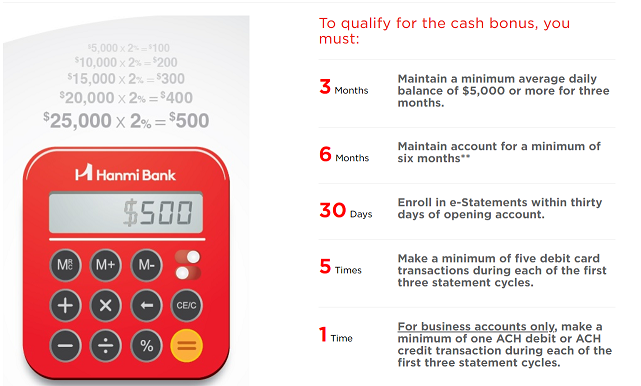

- Hanmi is offering a bonus of up to $500 when you open a new checking account. You get a bonus of 2% of your account balance, based on a 3-month average daily balance on the account for the first full 3-months ($25,000 for the full bonus). You must also complete the following requirements:

- Maintain a minimum average daily balance of $5,000 or more for three months

- Maintain account for a minimum of six months

- Enroll in eStatements within 30 days of account opening

- Make at least 5 debit card transactions during each of the first three full statement cycles

- Business accounts only: Make a minimum of one ACH debit or ACH credit transaction during each of the first three statement cycles

The Fine Print

- This offer is subject to discontinue when Regular Personal Checking account aggregate balance reaches $10 million or 1,400 accounts, and Regular Business Checking account aggregate balance reaches $20 million or 800 accounts, whichever comes first.

- This offer is valid only for new Regular Personal and Business Checking account customers who open the account with new money.

- New checking customer is defined as a customer who has not had any existing checking account with Hanmi Bank within the past 180 days.

- New money is defined as funds that are not held at Hanmi Bank.

- Customer must be at least 18 years of age.

- To be eligible for cash incentive, the new checking customer must provide a valid U.S. Taxpayer Identification Number (W-9) or a valid W-8BEN.

- Cash incentives will be considered interest and will be reported on a 1099-INT or 1042-S, as applicable. Customers are responsible for any applicable taxes and consulting a tax advisor.

- The 2% cash incentive is determined based on a 3-month average daily balance on the account for the first full 3-months. Starting date for the 3-month period will be the first date of the new month after the account opening; if the account is opened on the first day of a new month, that date will be the first date of the average balance calculation period

The 2% cash incentive is determined based on a 3-month average daily balance on the account for the first full 3-months.- Starting date for the 3-month period will be the first date of the new month after the account opening; if the account is opened on the first day of a new month, that date will be the first date of the average balance calculation period.

- The maximum incentive is $500 per customer in each account type (personal, business account).

- Cash incentive will be paid within 60 days after a qualifying account has been opened for three (3) full months.

- If the account is closed within the first six (6) months, cash incentive will be deducted at closing of the account if it has already been paid.

Avoiding Fees

Monthly Fees

- Super Plus Checking account has a $6 fee, but this is waived with a minimum balance of at least $5,000. This account also earns 0.05% APY on balances under $10,000 and 0.1% APY on balances above $10,000.

- Regular checking account has a $7 fee, this is waived with a minimum balance of at least $500

Early Account Termination Fee

Account needs to be kept open for at least six months otherwise the bonus is forfeit

Our Verdict

This basically works out to be a return of 8% annualized (really 8.1% APY if you do the super plus checking account) so it is worth doing. Not clear if you can do both the personal and business account. I’d recommend asking if they have hit the account caps ($10 million or 1,400 accounts for personal and $20 million or 800 accounts for business) before opening the account. This is really more of a savings bonus than a checking bonus, so I’ll add this to the list of the best savings account bonuses.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Did anyone receive a 1099-INT for their bonus paid out during 2020?

Yes. I received it by mail.

When I now login, account shows “There are no accounts available for display at this time”

I zero’d out the account on 3/26 so took 5 days for them to automatically close the account.

That’s a useful DP. I’ll never forget when I opened the account in-branch the woman half-jokingly (I think) told me she wouldn’t close it for me down the road.

Bonus posted. Opened on Oct 8.

Opened Oct 10, just had a conversation with a rep she told me I’ll see the bonus tomorrow as pending and available by March 31st

I called up and was told that once you zero out the account, the system automatically closes it 2-7 days later. Make sure you don’t zero out the account right before your next statement hits or you will be charged the monthly service fee. I hope this helps.

Received this from them via email that confirms this:

“To close an account

• For Checking account or regular savings account, transfer funds to other account or other financial institution, we may Close customer’s account if the account balance is zero.”

I zero’d out my account yesterday so will see how long it takes.

In this case, I waited to start the transfer of all the funds left in the account until Mar 23 because the statement didn’t come out until that day (even though my statement period ended on Mar 20), didn’t want to risk the penalty fee.

I don’t like the word “may” here. I will send them an email now so I have my own proof.

I just logged in and couldn’t find any way to message them. How did you do so? How long it take them to reply by email?

They won’t close the account by email but here it is: [email protected]

Thanks. If they don’t reply back by tomorrow I’ll just transfer the funds out and hope it closes in 5 days like it did for you.

They were fast in their email response, sent it in the morning and heard back that afternoon.

If they are listing it in months and not days then 6 months from September 20th is March 20th. If they meant 180 days, then you could have closed out your account on March 18th. Either way you are good to close now.

Anyone have any experience yet closing without going into a branch? With the current shut down, it is no longer convenient nor recommended to hop on mass transit to close the account. I’m about 1 week away from the 6 month mark.

I would like to have your comments and suggestions for my issue.

I signed up my account on September 25 and completed the 5 debit card transactions on September 30. On October 20, I received my first statement.

I do not receive the $500 bonus. I went to the branch and the banker explained to me that my first statement cycle actually started from October 1st. She showed me a print-out for the program details. However, on the print-out that it says starting from the first day of the next month after my account was opened, is for how to calculate the 3-month balance for the 2% interest. Under the bonus requirement part, it still says “complete 5 debit card transactions in the first three statement cycles”. She said I should complete the transactions in October. I did not agree with it. I showed her my first statement dated from September 25 – October 20. I said my understanding is that the period is my first statement cycle instead of October 1 – October 20. There is nowhere to say a statement cycle starting from October 1st. Each of mine statements started on the 20th of the month. The first day of the month in the print-out just means the period for calculating average daily balance (it is clearly under how to calculate the balance part and it has nothing related to the statement cycle).

What do you think? Am I right? I did not get the bonus because they still insisted that their explanation is right. I plan to bring the case the small claim court. Will I win?

Thanks.

This question was extensively discussed when the bonus first opened as to when the first 5 debits were needed to be done. There were conflicting comments based on different bank reps but no definitive answers were given.

To be safe, I recommended doing them before the end of the statement period of Oct 20 (actually the 18th because the 20th was on a weekend) and also thought it best to do after Oct 1, not in Sept because of the confusion with when the statement period actually began.

Can’t say you’re wrong (logically I’d agree with you) but whether you’ll be able to convince anyone of that legally, I don’t know.

Maybe someone who did the same as you and got the bonus can chime in.

Thank you for your input.

I am in Texas. If I do not get the bonus, I will bring the case to our state’s small claim court. I just checked that the fee is $34. I do not mind to lose $534 but I want to use this opportunity to get my first-time small claim court experience, as well as learn the truth and request fairness. If the judge is on the side of the bank, I will accept it. But I really do not think the bank is right to explain the terms in its way.

Why not file a complaint with the CFPB first off, it’s free to do.

You can always follow up in small claims if that doesn’t work.

Update:

I escalated the case to the branch’s manager yesterday. This morning, I saw $500 interest staying in my account.

Thanks for your discussion.

Anyone opened an account last Oct, and received the bonus? Thx!

Yes, I opened my account on 10.1.19 and received the bonus.

I signed up late Sept and recd the bonus 2,28,20

Any data point regarding how to close the account ? My only branch is about 30 minutes drive , but it make me feel better if the account can be closed by email or phone call.

Received full bonus of $500 on personal & buss both the ac/s on 28th Feb. Opened both acs end of september.

NIce & easy Bonus, bank is also good to deal with.

I always wait for a month to close both the accounts, so will close at 7th or 8th month. And any way its minimum balance only.

But now, today i saw mouth watering promotion for buss of $1500.

$1000 for Checking A/c

$500 for merchant services.

I think for buss checking a/c promotions it specifies only new customer. Will try to open merchant a/c for $500 promotion but will 1st check if i am eleigible or they just need completly new relationship

The Bus bonus is 2% of the balance, same terms as the personal bonus but at a higher limit.