The Chase Slate card is the only credit card Chase offers that doesn’t offer any sort of rewards program. It’s targeted towards people rebuilding their credit and those with existing credit card debt by offering introductory 0% APR rates and no balance transfer fees for the first 60 days.

Contents

Application Information

The Chase Slate is Chase’s most basic products, so if you don’t have much credit history then this is most likely to be your best option. That being said if you can’t take advantage of the introductory APR period then you might be better off seeing if you’re pre-approved for either the Chase Freedom or Chase Freedom Unlimited as both of these cards are also starter credit cards and come with a rewards program and sign up bonus.

What Credit Score Is Required

- Lowest approved score: 622

- Average approved score: 702

Common Reasons For Denial:

- Chase 5/24 rule does apply to this card. You will not be approved for this card if you have opened 5 or more bank cards in the past 24 months

- Bankruptcy on file.

What Credit Bureau Does Chase Pull For The Chase Slate?

This varies depending on what part of the country/what state you live in. I’d recommend reading this linked post for more information as well as datapoints for your specific state.

What Credit Limit Will I Receive?

Keep in mind that requesting a credit limit increase results in a hard pull with Chase. You can reallocate your credit limits if you hold other Chase cards though. The credit limit on this card is particularly important due to the 0% introductory APR and $0 balance transfer fee offers.

| Minimum Credit Limit | Highest Reported Credit Limit | Average Credit Limit |

|---|---|---|

| $500.00 | $25,000.00 | $6,057.00 |

Rewards Program

As mentioned this card does not have a rewards program. It is possible to product change this to other Chase branded personal credit cards that do have a rewards program. Any of the below are all options:

Card Benefits

0% APR & No Balance Transfer Fee

The two major draw cards for the Chase Slate are:

- No balance transfer fee for the first 60 days

- 0% Introductory APR for 15 months on purchases and balance transfers from account opening

Credit cards in general have insanely high interest rates (I mean after the initial 0% period the Chase Slate rate varies from 13.99% – 24.99%) so for somebody trying to get out of credit card debt this can be a valuable card. There are some restrictions on the balance transfer:

- You cannot transfer more than $15,000 or your credit limit (whichever is lower)

- Cannot transfer from other account or loans that Chase Bank issued

You can view other cards with 0% APRs and $0 balance transfer fees here.

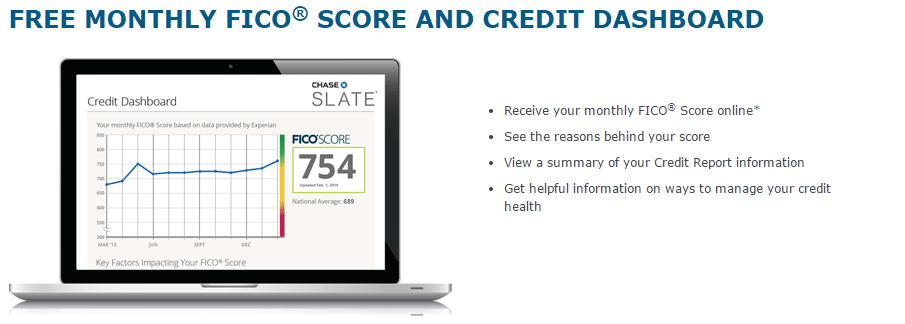

Free FICO Score

Chase Slate is the only card that Chase offers that comes with a free FICO score, even though this is a common credit card benefit now. The score they provide cardholders with is Experian classic 2008 model (EX-08) and is updated monthly. It should be noted that this is significantly more useful than Chase’s credit journey as that doesn’t provide a FICO score (it provides VantageScore 3.0). The difference is significant because most lenders do not use VantageScore so it’s only useful as an educational tool.

I don’t think a free FICO score provides much value to cardholders anymore given that Discover offers everybody (even if you’re not a cardholder) a free FICO score via their credit scorecard product.

Chase Offers

Chase has recently rolled out Chase Offers on this card and the Marriott cards. It’s similar to how American Express sync offers work where you’ll receive a statement credit for certain purchases. For example, spend $50 at Lowe’s and get $10 back.

Our Verdict

You really need to compare this card to other cards with no balance transfer fees and 0% APR offers. We have such a list here. As far as I know the Chase Slate is the best such offer. It’s really important to keep in mind that the credit limit you receive will play a major part in how useful this card is as well, for example if you receive a $500 credit limit but you have $5,000 in credit card debt you won’t be able to transfer the full balance over.

If you have credit card debt, you need to be very very very very very very careful about opening a new credit card as it’s very easy to accumulate even more debt and suddenly you’re in an even worse position than before. Cards like the Chase Slate can help provide some relief but I am hesitant to recommend them due to the potential downsides. If you think you’re in a position where you’re responsible about credit use and would be able to use such an offer to pay down your debt then this might be a good card for you.

After you’ve finished with the promo period that card isn’t of much use due to the no rewards program. Because of that it would make sense to product change this to either the Chase Freedom or Chase Freedom Unlimited.

For rewards chasers, chances are this isn’t the card for you. If you’re still eligible for Chase cards that fall under 5/24 then there will be options with a sign up bonus that is much more attractive than a 15 month interest free period. You can view a list of the best sign up bonuses here.

I was approved with a $500 CL, but I was able to move credit limit from a few other Chase personal cards to get it up to $29K.

One thing I was able to do, which is not mentioned in this thread but I have seen in other threads, is transfer balances (between $5K and $10K each) from cards which had zero or very low balances, and then get credit balance refunds.

With regards to the 95% limit, bear in mind that is 95% of your available credit. So if you to get the most out of your credit limit, do multiple transfers. (If your CL is $10K, you could a balance transfer for $9.5K. Your available credit would then be $500, and you would then be able to do another balance transfer for $475.)

The only thing I’m still trying to find out exactly is the last day I can transfer a balance under the promotion. If Chase gives some wiggle room on that 60 days, I’d like to get my second statement and make the minimum payment, which would then increase my available credit to do one last tiny balance transfer.

I was going to have 2/24 next month, but decided to try my luck at 3/24. I have 2 other Chase cards opened 3 years ago, a recently opened Chase biz checking, and was approved for CFU just prior to Slate being denied for “too many accounts w/ us”. I’m not really interested in PC, so I didn’t ask.

Does anyone know how long you have to wait to be able to be able to get a second Slate card? And is it that many months after closing/product changing or last Slate or opening of the card?

I know Sapphire has a 24 mo rule for that family but IDK about Slate.

Can anyone offer suggestions for me for my chase slate card? My 15 months at 0% is ending. Should i just go ahead and close the card? Any benefit to keeping it? I have plenty of other cards that i use regularly. I really dont see a need to keep it, unless anyone knows if they regularly send out bt offers at less than 3% fee with 0% apr. I almost cancelled my barclays card, and they sent me a 0% with 1% fee, and i was grateful i hadnt cancelled. Wondered if anyone knows if chase slate does this or if their discounted fee is 3% on their offers, being their regular fee is 5%. Im not gonna keep it if the best they can offer is 3% fee. In that case, can slate credit be reallocated to my freedom card? My slate has a $14,000 credit limit. I dont travel, so i wouldnt be interested in changing to those. I think the only interesting thing would be if i could change to a second freedom card so i would have 2 cards at 5% categories, but maybe they wont allow that? I know i can call chase for info, but reps are not as interested in what my best option might be. If it matters, i would prefer keeping it as is if they send out good bal xfer offers (0% with 1-2% fee). I like doing those and put thim in my 3.33%-4.5% bank accounts! 🙂

Hello!

Does anyone know if this card has any ongoing offers? For example, I had a Citi card and they constantly offered me more balance transfer offers. Same with my Bank of America card. Does chase still send you emails and letters enticing you to stay with the card and offering you good deals on balance transfers? If anyone knows that would be awesome! Considering this to get out of debt but if it doesn’t have any ongoing offers then it doesn’t seem very useful. Thanks again!

Is it possible to reallocate some credit line from another existing Chase card to Chase Slate right after (or within 60 days of) opening Chase Slate?

Possibly, haven’t thought about that before. If anybody tries it, please let us know.

The answer is yes. Don’t do it the same day your Chase Slate is approved but wait a business day or two. Max balance transfer limit with Chase is 15k every thirty days.

Good to know about the balance transfer limit. Also, I believe you can only balance transfer up to 95% of a CC’s credit line with Chase. So the maximum useful credit limit on the slate is $31,579.

If one has non-Chase CCs, with those CCs possessing 0.0% APRs expiring within the 60-day-window for this Slate Card’s NO TRANSFER FEE, would it be prudent to apply for this card, especially without knowing a priori what one’s Credit-Limit is likely to be?

If anyone might think of additional matters one need’s consider before one submits an Application, might they post to this thread, please?

The only thing I can think of to take advantage of this card is to MS the CL to a high rewards checking account such as Northpointe. Using highest reported CL $25K as example: interest= (25K x 5%)/12 x 15= $1562.50 but taxable.

Master list needs some serious updating.

Barclaycard Ring has been closed to new apps for the last couple of months.

Only other major $0/0% BT is Bankamericard 15mos/60days.

Yup, will update this.

May I ask: Where do you see Bankamericard having a balance transfer offer with a 0% APR and a 0% transfer fee? I’m looking on the site now, but I only see a 0% APR with a 3% transfer fee ($10 minimum). Is the 0% transfer fee offer targeted? Or am I simply looking in the wrong bank product? Thank you.

https://www.bankofamerica.com/credit-cards/products/bankamericard-credit-card/?campaign=4020245~TV~en_US

and

https://www.bankofamerica.com/credit-cards/terms-and-conditions/?campaignid=4020245&productoffercode=TV&locale=en_US&isMobile=true&format=ccr

Comment with links is currently awaiting moderation, but you’re probably looking at the wrong product. This one is simply called BankAmericard and is currently second from the top on their “View All Cards” tab.

It’s a step up from the Slate as it has a lower APR range, no penalty APR and after the intro only a 3% fee instead of Chase’s 5% fee.

Thank you for the links, Aahz.

Useless card. Any true churner can easily transfer balances whilst earning 1.5% rewards onto Freedom Unlimited, which has the same 0% APR for 15 months as this card, but actually offers a decent bonus as well.

MS’ing with VGC generally has a cost of 1%, so, for, say, 10k at 0.5%, you get a net write-off of 150 (MSR 500) + 25 (AU) + ~50 (net 0.5% on 10k), or, if you got the 300 offer, then even higher.

The Freedom Unlimited has a 5% balance transfer fee and the Slate does not. That 5% can easily negate the bonus if you’re transferring more than $3k.

CM isn’t talking about actually doing a Balance Transfer, they’re talking about using Manufactured Spend to simulate a BT.

You buy VGCs with a new FU and use them (via MO) to payy off your existing card with a balance, letting the new balance on the FU float at 0% for first 15 months.