Update 7/2/20: Convenience checking is only offering $150 bonus now, beyond checking still offering $300.

Offer at a glance

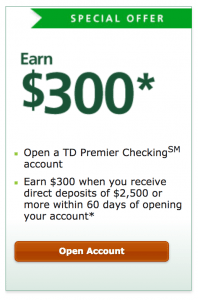

- Maximum bonus amount: $300

- Availability: CT, DC, DE, FL, MD, ME, MA, NC, NH, NJ, NY, PA, RI, SC, VT, & VA only

- Direct deposit required: Yes, $500+ for $150 bonus or $2,500 for $300 bonus

- Additional requirements: None

- Hard/soft pull: Soft

- Credit card funding: Up to $1,000 (a lot of cards process as cash advance)

- Monthly fees: Up to $25, waive-able

- Early account termination fee: Terms now say bonus forfeit if closed within six months

- Household Limit: None mentioned

- Expiration date: Unknown

Contents

The Offer

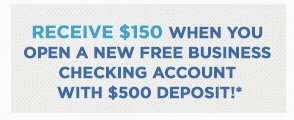

TD Bank is offering two checking sign up bonuses of $200 $150 and $300 depending on the account-type:

- Earn $200 when you open a TD Convenience checking account and receive direct deposits totaling $500 or more within 60 days

- Earn $300 when you open a TD Beyond/Relationship checking account and receive direct deposits totaling $2,500 or more within 60 days

The Fine Print

- Offer is available to new personal checking Customers who do not have an existing or prior personal checking account at TD Bank, open their account online via this web page and complete the required qualifying criteria.

- $300 bonus offer available to eligible new personal checking Customers when opening a TD Premier CheckingSMaccount with cumulative direct deposit funds of $2,500 or more into the new account within 60 days of account opening. $150 bonus available to eligible new personal checking Customers when opening a TD Convenience CheckingSM account with cumulative direct deposit funds of $500 or more into the new account within 60 days of account opening.

- Qualifying direct deposits are recurring electronic deposits of your paycheck, pension or government benefits (such as Social Security) from your Employer or the Government. Person-to-Person and bank transfers between your TD Bank accounts or accounts you have at other financial institutions or brokerages do not qualify.

- Once the offer criteria is met, the bonus will be credited into the new personal checking account no later than 95 days from account opening.

- Account must remain open, active, in good standing, and in the same product type through the qualifying period to receive the bonus.

- Bonus will be reported as taxable income to the IRS on a 1099-MISC.

- Offer may be withdrawn at any time and is subject to change.

- One bonus per Customer and cannot be combined with any other offer.

- TD Bank employees and Canadian cross-border banking Customers are not eligible.

Avoiding Fees

TD Convenience Checking $15 Monthly Fee

This is waived if you have a minimum daily balance of $100.

TD Beyond Checking $25 Monthly Fee

Monthly maintenance fee can be waived with one of the following:

- $5,000 or more in direct deposits within a statement cycle, or

- $2,500 minimum daily balance is maintained, or

- $25,000 minimum daily combined balance of all deposit accounts, all outstanding loan accounts, and/or mortgages in good standing (excludes credit card) that you choose to link

Early Account Termination Fee

In their online fee schedule, there is no mention of an early account termination fee. This comment confirms the same. The terms themselves now say that the account needs to be kept open for six months or the bonus is forfeit.

Our Verdict

Given that you can only get this bonus once per lifetime, it’s worth going for the $300 bonus as it’s not that much more difficult to trigger the bonus requirements or keep it fee free. $300 is also the largest bonus we’ve seen on this account (it fluctuates between $150/$300 and then reduced to $100/$200). We will be adding this to our list of best checking promotions.

If you run into the issue of them being unable to verify your identity, try using your passport instead of your drivers license. Also according to this you can open out of state via phone, but not possible to get the bonus (share any other date points you have below).

(Hat tip: can’t remember who)

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

Hey! I opened TD bank back in 2018 and closed it in 2020.

If i open a new one for sign up bonus, does it still works?

Thank you!

Has anyone had any luck with this bonus recently I just signed up for the $400 bonus

Hello! May I ask for a link for the $400 bonus? Is it targeted? The public website only shows $200 and $300 bonuses. Thank you!

DP – Bonus-earning and account-closing data points:

– 8/10/2020 – Account (Beyond Checking) opened

– 8/13/2020 – ACH deposited/transferred $2600 into the account from E*Trade

– 9/14/2020 – ACH deposited/transferred $2520 into the account from Wells Fargo

– 9/15/2020 – ACH deposited/transferred $2510 into the account from PNC

– 10/27/2020 – $300 bonus deposited into account

– 9/9/2021 – Requested that account be closed (over-the-phone).

– 9/13/2021 – Account closed

DD Data Point

Sold some stuff on Ebay, was paid through Paypal, & transferred the funds to my TD Bank account.

Shows as DIRECT DEPOSIT.

Did you get the bonus yet? Just curious if the Paypal DD actually works. Thanks!

Since I don’t personally bank with Chase, can someone else transfer the required amount from Chase to me and it qualifies as DD? I tried looking up on their website but didn’t see anything like fund transfer other than wire, which we would like to avoid. Any ideas ???

“Customers who received a bonus on a prior checking and/or savings account do not qualify. TD Bank employees and Canadian cross-border banking Customers are not eligible.”

The current TD offer states this. FYI.

https://checkingbonus.tdbank.com/Digital500.html

Push from my Schwab Brokerage and shown as DIRECTDEP. However, when I sent a message to the customer service, they told me this transaction is a mobile deposit not DD. Maybe I shouldn’t contact them.

Don’t draw any attention. You really shouldn’t have contacted the bank.

https://www.doctorofcredit.com/dont-call-the-bank/

Just funded my TD from Chase (used my information at sign up and sent over 2500 to avoid fees). Looking in my account now, the transfer from Chase is showing as “DIRECDEP”

Tried to fund the account with Chase Ink Cash. The transaction was rejected.

Has anybody experienced a rejected credit card funding?

Today 2/3/21 I opened online a TD Convenience Checking acct. & was surprised to see it could be funded with credit or debit. TD online accepted the $100 initial funding depo with credit good to go, then 10 minutes later I get an email from Suntrust CC saying they declined it & locked out the card for security reasons! Called Suntrust and unlocked card. Will stop by branch with good ole cash to keep 2/3/21 as the open date. Most accounts are not opened UNTIL they are funded. Also, with CC funding your taking a chance of extra fees.

Opened: July 26

Met requirements: August 13

Bonus posted: November 24