This bonus has expired and is no longer available. Click here for a list of the best banking bonuses.

Offer at a glance

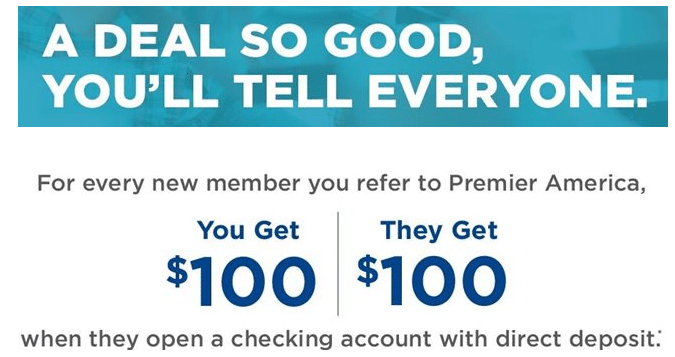

- Maximum bonus amount: $100 for both parties

- Availability: Locations in California & Texas [Branch locator]. In branch only (maybe not)

- Direct deposit required: Optional, $100+

- Additional requirements: 3 debit card transactions per month for 90 days

- Hard/soft pull: Soft (make sure you opt out of overdraft protection)

- ChexSystems: Unknown

- Credit card funding: Yes, varies by product (at least $500)

- Monthly fees: $0+

- Early account termination fee: None

- Household limit: None mentioned

- Expiration date: None mentioned

The Offer

- Premier America Credit Union is currently offering a $100 referral bonus for parties when the person opening a new checking account completes ONE the following requirements:

- Enrolls in monthly direct deposit of $100 or more OR

- Makes at least three monetary debit card transactions per month for the first 90 days

- This is the referral form that needs to be completed

The Fine Print

- Referring member and new member earn $100 each when the new member opens a checking account and enrolls in monthly direct deposit of $100 or more; or makes at least three monetary debit card transactions per month for the first 90 days.

- $100 will be paid after 90 days if the checking accounts remain open and in good standing.

- Offer is subject to change or end without notice.

- New members and accounts are subject to approval.

- Existing members who open checking accounts are not eligible.

- Premier America reserves the right to disqualify any referral in circumstances where we reasonably believe they are not made in good faith.

- $100 incentive will be reported as dividend income.

- Other restrictions may apply and must be 16 years or older to qualify.

- An initial deposit of $5 in a share savings or $250 in a business savings account is required to join Premier America. ederally Insured by NCUA.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

The easiest account to keep fee free is the totally free checking account, as it doesn’t have a monthly fee. I wasn’t able to find an early account termination fee in their fee schedule.

Referrals

Reader Shawn signed up for the account with no bonus so he could refer people. E-mail him to get more information: [email protected].

Our Verdict

This bonus is significantly better than I first thought as a direct deposit is not required and it’s a soft pull to open. Even better if you can refer some friends & family members as well. This will be added to our best checking bonus page.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

Appears promo is active again, but bonus reduced to $50 for each party

Not worth it

as a DP I tried applying a few days ago and got rejected due to many inquiries, it seems that for anyone who has 3+ inquiries within 90 the past days they get flagged and they need approval from their risk management department. was also informed that the promotion is ending within a week.

Bonuses appear to be posting on the last thursday of the month

Just Dp opened online with them already opened 12 accounts this year

funding Merrill+ 500 each product checking saving and money market total 1500 code as purchase

according to reps this was in branch only

Yall read the 90 days for bonus to post as being after opening or after the reqs are met? Seems vague enough to be either. Been >90 days since opening and nothing.

Still no referral bonus for me as well… I’m assuming 3 debits per month for first 90 days means first 3 months, and we just need to wait for this month to end. Let us know what you find if you communicate with them

Just had a Refer a friend bonus post.

I can send a referral as well if anyone needs it. Email me at [email protected]

APY for checking > 5000 is 2% without any restriction? APY for saving is 1.5%? That’s really a good rate.

Please reply here or contact me at [email protected] if anyone is looking for a referral to open a checking account with them and get $100 bonus.

I dont know if this is the right organization i am looking at, but it seems the Alliance for the Arts is $55 to join as a member?

if so, the offer seems much less attractive for those who live in area without branch.

https://artinlee.org/join/

This is not the right organization. The one they have has only $10 joining fee.

Opened an account yesterday. Another cofirmed soft pull and did not attempt CC funding.

Will confirm Chexsystems sensitive so be wary if you’re 10+ in the last 6 months I’d say. YMMV with this. Of course will welcome and appreciate use of my referral. Shoot me an email. Thanks!

[email protected]