Deal no longer being offered, view more bank account bonuses by clicking here

Offer at a glance

- Maximum bonus amount: $150

- Availability: NY or CT only

- Direct deposit required: No, but must deposit $200 monthly for three months

- Additional requirements: See below

- Hard/soft pull: Soft pull

- ChexSystems: Unknown, sensitive (not sensitive in branch)

- Credit card funding: Up to $1,000 with Visa, Mastercard or Discover

- Monthly fees: None

- Early account termination fee: Unknown

- Household limit: None

- Expiration date: None listed

Contents

The Offer

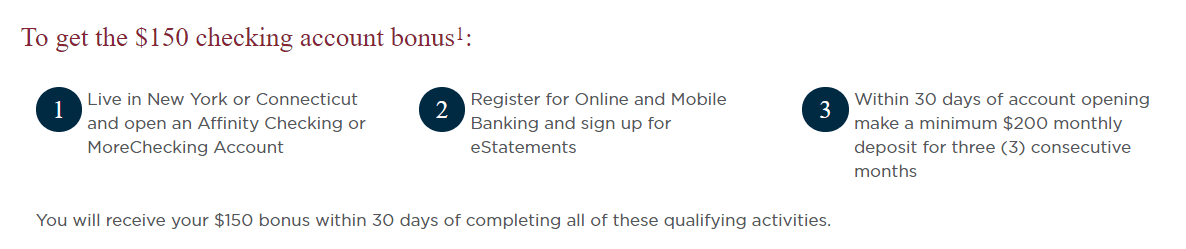

- Affinity Federal Credit Union is offering a bonus of $150 when you open a new checking account and complete the following requirements:

- Register for online and mobile banking and sign up for eStatements

- Within 30 days of account opening make a minimum $200 monthly deposit for three consecutive months

The Fine Print

- . To receive the $150 bonus, you must reside in New York or Connecticut and open an new Affinity Checking or MoreChecking; make one deposit totaling $200 or more, per month, for 3 consecutive months.

- The monthly deposit of $200 or more must be made by direct deposit, a transfer from another financial institution, mobile deposit, ATM or at any Affinity branch.

- The first deposit must be made within 30 days, the second deposit within 31-60 days and the third deposit 61-90 days of the account opening date.

- You must register for Online and Mobile Banking and sign up for eStatements in Online or Mobile Banking within 30 days of account opening.

- Offer valid only for new members who join Affinity within 30 days of opening the checking account or existing members without an Affinity Checking or MoreChecking account.

- Bonus will be deposited into your checking account within 30 days of completing the qualifying activities.

- Bonus offer excludes Business checking, Teen Checking and Revolution Spend accounts. Bonus may be reported as taxable income.

- Limit of one checking bonus per member.

- Additional exclusions may apply. Offer subject to change without notice. Affinity Checking:

- There is no minimum opening deposit or balance requirement. MoreChecking: There is no minimum opening deposit.

- Minimum balance to earn the standard 0.05% APY is $1,000. Rate may change after the account is open. Fees could reduce earnings.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

Avoiding Fees

Monthly Fees

Affinity checking has no monthly fees to worry about

Early Account Termination Fee

I wasn’t able to find a fee schedule

Our Verdict

This looks to be a good bonus, assuming it’s a soft pull to open. If anybody goes for it please let us know if it’s a hard or soft pull in the comments below. Affinity Federal also has a business checking bonus for up to $400. This bank also offers a card that has a $200 sign up bonus and 5% back at bookstores.

Hat tip to reader RT

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

Membership eligibility is $5.

To receive the $150 bonus, you must: 1) Open an Affinity Cash Back Debit account online using the Apply Now button on this webpage on or before December 31, 2021. 2) Make recurring, qualifying direct deposits of $500 or more per month for three consecutive months. The first direct deposit must be made within 30 days, the second deposit within 31-60 days and the third deposit 61-90 days of the account opening date. 3) Make 10 or more purchases with the debit card associated with your Affinity Cash Back Debit account within 90 days of the account opening date. Qualified debit card transactions include signature and PIN based debit transactions in person directly at a merchant location or in app or online merchant sites

DP: funded account with chase united explorer on 02/19 for the $1000 max coded as purchase!

Anyone got an image of the offer that shows the expiration date? I just got burned by not having captured it. And yet people appear to have also applied for into May…

“I looked into the promo that we were offering and as mention it ended 3.31.20”

The bonus has been pulled.

I was not able to fund it with credit card and the fees went up to $10 and i had to put in my ACH and had to submit my DL copy

same here, got approved 2 days later

I was able to fund $1000 with a credit card.

Thanks, updated

I signed up for this bonus on 4/27. Received a phone call on 4/28 asking for some basic information to confirm my identity. When I asked about being eligible for the $150 bonus, I was told the offer has expired. I was signing up as a New Yorker who has family in NJ. I had them cancel my application.

Applied 4/15, looks like a soft pull. Obviously opt out of overdraft protection. From the wording it sounds like this is not churnable, but easy requirements and cc funding.

Were you able to fund it with a CC? Post says no CC funding

Were you able to fund with a CC? If so, which card? Post says no CC funding

Were you able to fund with a CC? If so, which card? Post says no CC funding

opened 6/1019 with $200 deposit…was told by CS in branch that my opening deposit counted as the first of three necessary for bonus. ACH transfer in a month and then two months later. Done with last qualifying deposit by 8/14/19. Had to call bank to ask why bonus cash had not posted. Bonus $ Finally posted on 10/1/19

Any idea why NJ is specifically excluded in this offer though they have branch locations in NJ?