Deal has expired, view more bank account bonuses by clicking here

Update 3/7/20: Deal has been extended until APril 27th, 2020.

Update 1/12/2020: Deal is back and valid until March 6th, 2020.

Update 9/18/19: Deal is back and valid until September 27th, 2019. Hat tip to Chong786

Update 7/2/19: Deal is still valid, but in-branch only now.

Update 6/7/19: Bonus is back and valid through August 6th. You can alternatively do this $300 checking + $200 savings + $100 combo bonus. (ht reader chong786)

Keep in mind this now contains the new two year language.

Update 04/24/18: Bonus is back and valid until June 14th, 2018. I wonder if this will work in states with no branches as the last Chase checking bonus did. Hat tip to nruhc

Orignally posted on November 13th, 2017. Reposting on November 22nd, 2017 due to the fact there is now a public link. Thanks to reader Ender L for the information.

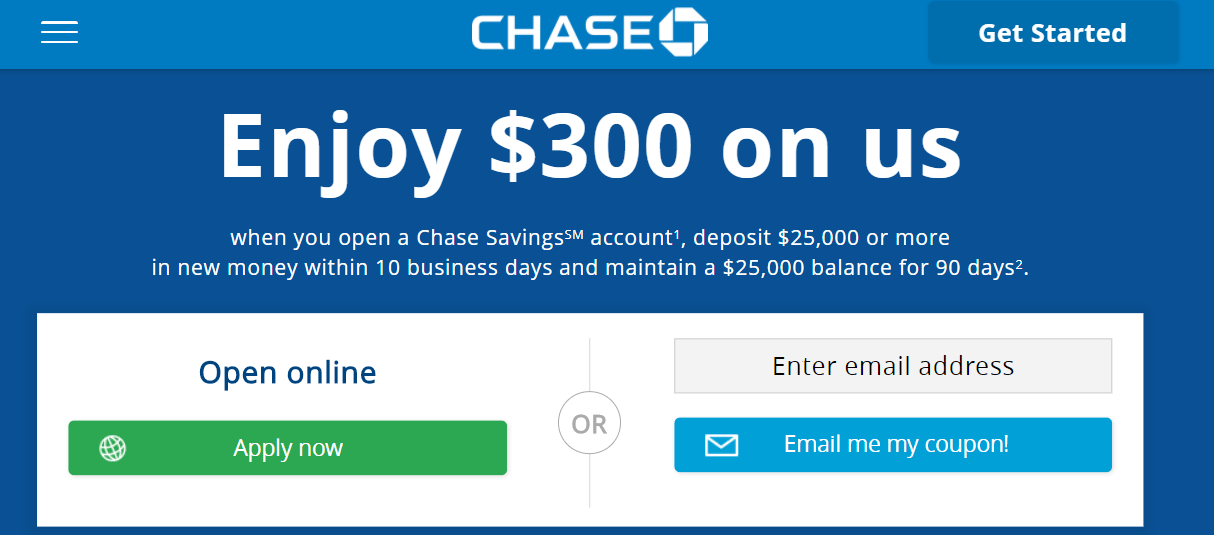

Offer at a glance

- Maximum bonus amount: $300

- Availability: Nationwide

- Deposit required: $25,000

- Deposit length: 90 days

- APY: 0.01%

- Hard/soft pull: Soft

- ChexSystems: Unknown

- Credit card funding: Not available when opening in branch

- Monthly fees: $5, avoidable

- Early account termination fee: Six months, bonus forfeit

- Household limit: None

- Expiration date:

January 16th, 2018March 3rd, 2018 March 10th, 2018 June 14th, 2018 August 6, 2018 September 27th, 2018 November 20th, 2018January 17th, 2018 August 6, 2019 September 27th, 2019 November 19th, 2019January 11th, 2020

The Offer

- Chase is offering a bonus of $300 when you open a new Chase Savings account and deposit $25,000 or more in new money within 10 business days of account opening and maintain that balance for 90 days.

The Fine Print

- Savings offer is not available to existing Chase savings customers, those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance.

- To receive the bonus: 1) Open a new Chase SavingsSM account, which is subject to approval; 2) Deposit a total of $25,000 or more in new money within 10 business days of account opening; AND 3) Maintain at least a $25,000 balance for 90 days from the date of deposit.

- The new money cannot be funds held by Chase or its affiliates.

- After you have completed all the above requirements, we’ll deposit the bonus in your new account within 10 business days. F

- You can only receive one new savings account opening related bonus every two years from the last enrollment date and only one bonus per account

- The bonus is considered interest and will be reported on IRS Form 1099-INT(or Form 1042-S, if applicable).

Avoiding Fees

This account has a $5 monthly fee that is waived if you do any of the following:

- Maintain a daily balance of at least $300 or more

- Have at least one repeating automatic transfer of $25 or more from your Chase personal checking account

- Are under 18 years of age

- Have a linked Chase Premier Plus, Chase Premier Platinum Checking or Chase Private Client checking account.

Our Verdict

Chase typically offers two savings bonuses:

- $200 for depositing $15,000 and maintaining for 90 days

- $150 for depositing $10,000 and maintaining for 90 days

Your return actually decreases as the bonus increases. This deal works out to be over 4.8% APY, not outrageous for a savings bonus but still pretty good. Keep in mind some savings accounts offer 5% long term so those might be better options for some people. If you’re considering this offer make sure you do the $300 checking bonus at the same time as well. I’d also recommend checking for in branch pre-approvals as these by pass the dreaded 5/24 rule. I won’t be adding this to the best savings bonuses because it’s targeted.

Big thanks to reader, Stephen E & Gary M who let us know. Learn how to find bonuses and contribute to the site here.

Useful posts regarding bank bonuses:

- A Beginners Guide To Bank Account Bonuses

- Bank Account Quick Reference Table (Spreadsheet) (very useful for sorting bonuses by different parameters)

- PSA: Don’t Call The Bank

- Introduction To ChexSystems

- Banks & Credit Unions That Are ChexSystems Inquiry Sensitive

- What Banks & Credit Unions Do/Don’t Pull ChexSystems?

- How To Use Our Direct Deposit Page For Bank Bonuses Page

- Common Bank Bonus Misconceptions + Why You Should Give Them A Go

- How Many Bank Accounts Can I Safely Open Within A Year For Bank Bonus Purposes?

- Affiliate Links & Bank Bonuses – We Won’t Be Using Them

- Complete List Of Ways To Close Bank Accounts At Each Bank

- Banks That Allow/Don’t Allow Out Of State Checking Applications

- Bank Bonus Posting Times

We just learned that Chase disqualified us for the $300 bonus after opening a saving account and transferred the required money via Bank Transfer by Jan 1st and keeping it for 3 months (March 1st) because we did not drop the money “manually” and did it through bank transfer. They are just making it harder for anyone to get the bonus. Be careful everyone!

01/21/20: Account opened

01/23/20: $25,000 deposit

04/28/20: $300 bonus received

Thanks, DoC!

Now deadline is November 19.

$25K balance for this offer VS Heritage Bank at 3.33% = $92 net bonus, not worth the hassle. Also, I didn’t find any mention about limit of offers of 2 years within the terms.

I got $225/$15k offer

I opened a savings account almost 3 monnts ago and the bonus was posted about 85 days after the deposit. I was tempted to withdraw most of it (due to the paltry .01% int rate) but figured I better wait the full 90 days, otherwise they might reverse the bonus. Anyone else notice this?

Yeah I had the same thing. The bonus posted around 95 days after account opening and 70 days after the 65 days after the deposit.

https://accounts.chase.com/consumer/banking/online/savings010318

This offer is back !

You need to open by sep 27th 2019

I opened a Saving account early this year but no bonus was given. Closed last March. Opening it again still eligible for the bonus?

My wife received a $300 bonus offer for opening a new savings account, coupon code KC62 4993 37RA 9VGC expiring 9/28/19. She has Alzheimer’s and can’t take advantage of the offer. I had a savings account with Chase that I closed on or about 5/26/17. Can I take advantage of her offer if I open a new savings account with $25,000 in her place?

Ask them, I think they would approve it. You usually have more luck with the bankers in branch but YMMV.

Is a direct deposit required?

No